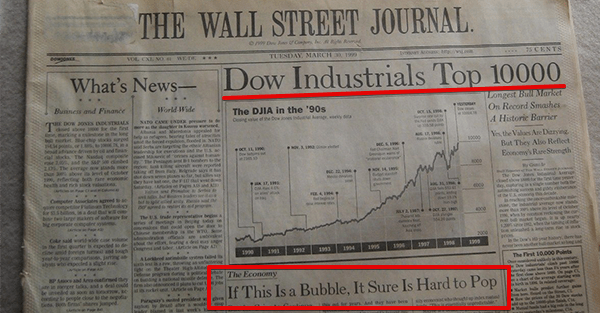

On March 30, 1999, the Wall Street Journal’s front page headline blasted the good news across the world:

“Dow Industrials Top 10,000”

The day before, the all-important US stock index, the Dow Jones Industrial Average, closed above 10,000 for the first time in history.

It was a major milestone, and investors cheered.

A few investors, however, were concerned.

They felt that US stocks were too expensive, and the entire market was in a dangerous bubble.

But the Wall Street Journal answered those naysayers, as the headline of the second article on the front page ominously read:

“If this is a bubble, it sure is hard to pop.”

They were right. Sort of. The Dow Jones Industrial Average continued to climb for the next 8 1/2 months.

But on January 14, 2000, it peaked… and then started a horrible 2-year decline that wiped $5 trillion of wealth from investors.

Yesterday the Dow Jones Industrial Average hit another major milestone: 20,000.

You might even have heard the sound of champagne bottles being simultaneously uncorked by jubilant traders at 4pm Eastern Time.

But Dow 20,000 should give any rational individual pause to reflect on the possible consequences.

After all, the single most important characteristic of any investment is the price when you buy it.

It doesn’t matter how spectacular your investment is. If you overpay for it, you have no margin of safety.

And as the market affirmed yesterday, US stock prices can be expressed in a single word: expensive.

It’s not the fact that the Dow hit 20,000 that makes US stocks so expensive. The price of a stock alone doesn’t tell you much.

It’s important to look at the price of the stock relative to other important metrics, like cash flow, book value, sales, earnings, etc.

US stocks right now are selling at the HIGHEST price-to-sales ratio in at least 15 years, and far higher than it was before the 2008 crash.

Similarly, the cyclically-adjusted Price/Earnings ratio of the US stock market is now at its highest level since the 2000 crash, and higher than it was before the 2008 crash.

Looking at other metrics like Enterprise Value to EBITDA (a measure of a company’s core business operating cashflow), US stocks are also at their most expensive levels since the 2000 crash.

Certainly, US stocks could continue to become more expensive. Perhaps they go up forever.

Or perhaps an astute investor should start looking for a margin of safety.

Once significant measure of safety is a company’s Price/Book ratio. This is essentially a reflection of how much an investor is paying relative to the value of a company’s “net worth”.

This matters.

In his book What Works on Wall Street, author James O’Shaughnessy conducted an analysis of the investment strategies that were the most (and least) successful in the US stock market for a period of over 50 years.

One of the most successful strategies? Buying companies with LOW Price to Book ratios.

One of the least successful strategies? Buy companies with HIGH Price to Book ratios.

Over the long run, value investing beats just about everything. And these extremely high multiples in the US market clearly do not qualify as good value.

This is not to say that the entire US market is overvalued; there are still pockets of value in North America. But they are becoming much more difficult to find.

Looking abroad, however, there are a number of other markets overseas where valuations are MUCH more attractive.

If North America stands out by way of high valuations, for example, Japan stands out by way of low and attractive ones.

One third of the entire Japanese stock market has a cash flow yield (Enterprise Value / Cash From Operations) of over 15%.

No other developed market comes close to that.

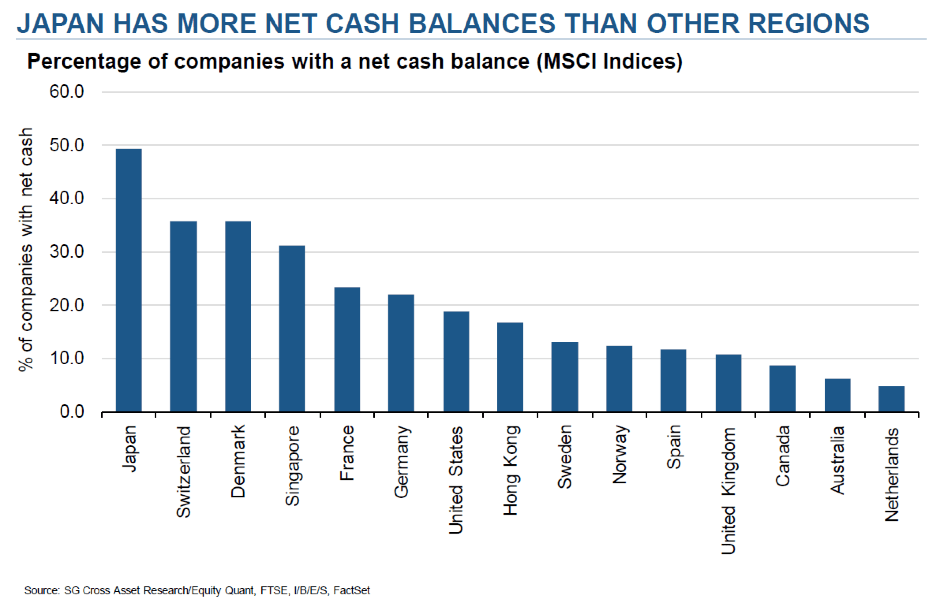

And as analysts from European bank SocGen point out, Japanese companies also have more net cash than listed businesses in any other country:

More importantly, Japanese companies are being actively encouraged to pay higher dividends and buy back their shares.

Whereas the balance sheets of US companies are groaning with years of accumulated debt, Japanese balance sheets are the healthiest in the world, and they are awash with cash to give back to their shareholders.

Japan is very enticing to value investors, and it’s a great example of how looking abroad and expanding your thinking to the entire world can yield very compelling results.