Education is a BIG part of a having a Plan B… especially when it comes to money.

In light of the obvious risks that we discuss on a regular basis, safeguarding (and growing) our savings is absolutely critical.

Finance can be a little bit scary and seem quite complicated at first.

No one comes out of the womb a financial expert. And they certainly don’t teach this stuff in a government-controlled public school system.

But just like speaking a foreign language or learning to drive, knowing how to properly manage money is a SKILL.

And it’s one that can be learned. By ANYONE.

The difference between knowing versus NOT knowing how to manage money can have an EXTRAORDINARY impact on your life.

Simply being able to generate an extra 1% to 2% annual return on your investments can add up to hundreds of thousands of dollars in extra wealth over 20-30 years.

As with any other skill, learning about finance takes some time and patience. But the reward is extraordinary.

I wanted to pass along an email today that highlights key characteristics of the world’s most successful long-term investment strategy.

It was written by my friend and colleague Tim Price, a UK-based wealth manager who is a disciplined master of “value investing”.

This strategy is absolutely worth understanding. Learning it can truly have an enormous impact on your life.

— From Tim: —

Successful investing involves having an edge.

And if you do not know what your edge is, you do not have one.

There are doubtless many investors who, in the absence of a general investment strategy, randomly buy stocks, many of which they hear about on CNBC.

Other individual investors have dutifully followed conventional financial wisdom and have bought large index funds, like the S&P 500.

In this way, investors are essentially owning a small share of the entire stock market.

But Snapchat’s looming IPO highlights a lurking problem with this approach.

Snapchat is a California-based photo-sharing social network. It loses money and lacks a credible plan for long-term growth.

The company itself acknowledges that they may never turn a profit.

Yet Snapchat will soon IPO at a share price that will value the company at $30 billion, more than the GDPs of Iceland, Cameroon, Latvia, and Cyprus.

Investors are of course welcome to pour their money down whichever drains they choose.

The interesting thing, though, is that after it goes public, Snapchat will eventually become part of the S&P 500.

(This is the stock “index” of the 500 largest companies in the US, like Apple, Exxon, etc.)

There are dozens of mutual funds and “exchange traded funds” which follow the S&P 500, i.e. they own shares of each one of the 500 companies that comprise the index.

So once Snapchat joins the S&P 500, every single fund that follows the index will be obliged to buy shares of Snapchat.

This means that buying into large index funds guarantees exposure to low quality, expensive, risky assets.

Active investment management requires doing something different from the herd.

It requires focusing on what actually works instead of following the crowd.

So which investment strategy actually works?

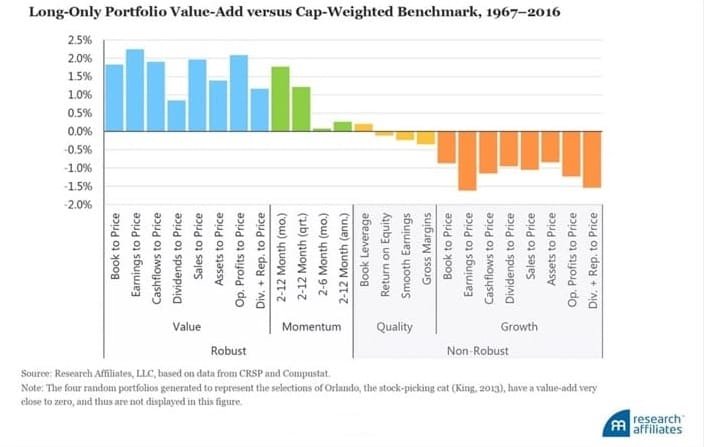

One fascinating 49-year study by Research Affiliates highlights the best and worst performing strategies over the longer term for equity investing.

The best performing strategies, by far, were all value investing strategies.

You may not be familiar with some of the terms, i.e. Price-to-Book, Price-to-Sales, etc.

But value investing essentially boils down to buying the highest quality assets at the cheapest possible price.

Here’s a simplistic example:

Let’s say that the share prices of XYZ, Inc. and ABC Ltd. value both companies at $1 billion.

XYZ is flush with cash, generates $950 million in annual profit, has no debt, and $5 billion worth of high quality assets.

ABC is in debt up to its eyeballs, loses money, and has very few assets.

Both companies are essentially selling for the same price. Which would you choose?

Clearly XYZ is the better deal; you’re buying high quality assets at a discount, and you’ll make your money back in just over a year.

This “discount investing” natural sense to our species. We’re always looking for a great deal, whether it’s on a new car or steak dinner.

Investing should be no different.

There are plenty of high quality, profitable, well-managed companies whose shares can be bought in major stock markets around the world.

Some of those shares are incredibly expensive relative to the company’s true worth. Others are selling for astonishing discounts.

The challenge is knowing which is which.

Value investors have the skills to tell the difference. And that’s precisely what value investing is– a skill… and one that can be learned.

It’s worth learning, too.

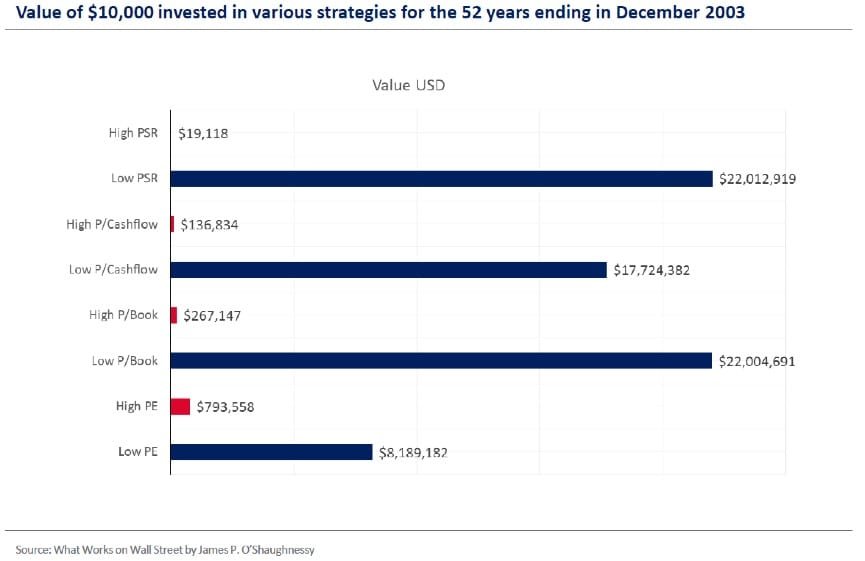

The findings from the 49-year Research Affiliates study are consistent with a similar study conducted by James O’Shaughnessy in his book ‘What works on Wall Street’, the results of which are shown below:

Again, you may not be familiar with the terms, but O’Shaughnessy’s study shows that the four value investing strategies vastly outperformed.

A value strategy would have turned $10,000 into $22 million over the period in O’Shaughnessy’s study.

Given such obvious data, why would investors favour any other approach ?

Simple.

Value investing requires patience.

The share price of a company that’s trading for a steep discount can languish for months, even years.

Successful value investors must have the patience to buy great companies at a discount… and then do NOTHING.

Most investors do not have this much patience.

But the long term returns are worth it.

PS:

You can learn more about Value Investing in my recent video podcast on how to find the most compelling investments on the planet.

Here is what one of our subscribers said about it:

“Would you please pass along my thanks to everyone who contributed to the recent podcast about value investing?

I found the EVE to Leveraged Free Cash Flow explanation illuminating. I used it to evaluate which of my remaining US stocks to sell first if need be.

Even though I’m starting out, I also used it to evaluate (and to decide to pass on) a private business, and I’ll use it when I evaluate another private business in the near future.

I heard you got plenty of positive feedback about your two recent Black

Papers, and I want to make sure you get positive feedback about the podcast

too. You guys rock!”

– Ben, Subscriber of Notes from the Field