4 Ways To Store Value

and Protect Your Wealth

-

AUTHOR

James Hickman -

PUBLISHED

September 3, 2020

The dollars in your bank account lose about 2% of their value to inflation every year.

But the way 2020 has been going, the inflation rate could soon become a lot worse, seriously eroding the value of your money.

But real assets, including the value stores we discuss here, rise in value under these conditions.

The excessive US government debt fuelling inflation has been a problem for a long time.

But in 2020, the US government will borrow a record $3.7 trillion in new debt to pay for all the COVID handouts.

That smashes the previous 2009 record of $1.6 trillion of debt, which included the bailouts in response to the Global Financial Crisis.

Most of that debt is financed by borrowing from the Federal Reserve. And the Federal Reserve simply prints the money.

That means the US is conjuring a record amount of dollars out of thin air, at a time when the economy is shrinking due to the Covid lockdowns shutting down business and tourism. This is likely to lead to extreme inflation.

The trick is getting your cash into a store of value BEFORE everyone else does. Otherwise, the prices rise, and you get less value for your dollar.

And that is why it is imperative to search for a store of value for your wealth outside of the monetary system.

Here, we will present different real assets that maintain or grow in value. This is how you can store value and protect your wealth, outside of currency.

Back when the US dollar was on the gold standard, you could simply deposit your money in a bank account, and voila, your wealth was pretty secure.

Money was a good store of value because every dollar could be redeemed for gold. And gold has been a store of value for 5,000 years because of its scarcity, and desirability.

But now the dollar– and every other currency around the world– is a “fiat currency.” That means it has value only because governments say so.

That works well enough when everyone has faith in the system. And when the government is responsible with the supply of money.

But the more dollars that are added to the supply of money, the less value each dollar has.

That is called inflation.

The US dollar has been hovering around a 2% inflation rate for the past couple decades. So $100 deposited into your bank account this year will only be able to buy $98 dollars worth of goods and services next year.

Again this wouldn’t be a huge problem if the interest rates banks paid were above 2%– a savings account would still be a net gain.

But they aren’t. You’re lucky to get a .1% interest rate.

How money (and inflation) is created

The Federal Reserve prints the US dollar, and either lends it to the government to be distributed, or buys assets with the newly minted cash.

To pay for all these assets it acquires (Treasury bonds, mortgage-backed securities, etc.), the Fed conjures digital money out of thin air.

From the Federal Reserve’s founding in 1913 until the 2008 Global Financial Crisis, the Federal Reserve’s balance sheet grew from $0 to about $800 billion.

Then, in about six years, the Fed took its balance sheet from $800 billion to about $4.5 TRILLION.

It took almost 100 years to distribute $800 million– and SIX years to pump out 5.6X that amount.

And then in March 2020, the wrecking ball known as COVID-19 hit the United States.

The economy shut down. Production stalled. Tens of millions became unemployed. The US federal government authorized a $2 TRILLION emergency spending bill.

Over at the Fed, they were hard at work, too. In just over two months, the Fed went on an asset buying binge, growing its balance sheet from just north of $4 trillion to over $7 trillion.

In TWO MONTHS the Fed bought 4X as much it had in 95 YEARS.

And again, all that money was conjured out of thin air.

The Fed is completely unhinged. By the time this round of money printing is over, their balance sheet could be $10 trillion, $15 trillion or more.

That means at a time when the economy has stalled, an unprecedented amount of money is chasing after fewer goods and services.

If you expect that the Fed will continue to conjure trillions of dollars– even tens of trillions of dollars– out of thin air and that the US government will further ramp up its epic spending, then this scenario may translate into much higher price inflation.

Higher prices at the grocery store. Higher prices on Amazon.com. Higher prices for various services. Higher prices, in general, just about everywhere.

And as prices climb, this should change consumer behavior. People will trade dollars for real goods as quickly as possible, which might further fuel higher consumer prices, which could create even more demand, which could increase consumer prices, and so on…

As such, it’s high time for creative, thinking people to consider their options and…

Start trading your pieces of paper for something of value.

We all know the familiar story about precious metals– gold and silver have a long-standing tradition as stores of value dating back thousands of years.

But did you know, for example, that in the early days of the United States, whiskey was both a store of value and a medium of exchange?

At the time, the US had among the highest alcohol consumption per capita in the world… and people knew they could always trade whiskey for something else. As such, whiskey had significant value.

Now, today’s liquor fundamentals may not warrant rushing out to buy a home-brew distillery kit… or stocking up on Johnnie Walker.

But there are a number of other alternative stores of value– from art to watches to farmland– worthy of your consideration.

What is store of value?

A store of value is a place to safely park your wealth where it won’t depreciate. For example, gold has maintained value for thousands of years, and it doesn’t rust or decay, making it a good store of value.

Most cars, in contrast, depreciate rapidly, and require constant maintenance, which makes them a bad store of value.

We’ve already discussed how dollars– and basically every other currency– constantly loses value due to inflation.

So the goal is to convert fiat currency into something that will not lose value, or could even grow in value.

You want to buy something with your dollars that will not depreciate, or become worthless over time.

A store of value is also NOT usually a means of exchange, like currency– though it can be.

When silver and gold were still used as currency, it was both a store of value and money.

Store of value example: Precious metals are the most classic example of a store of value, because gold and silver have maintained their value for 5,000 years. There is evidence from the earliest civilizations on earth that gold and silver were considered valuable.

Even 1,000 years ago, the price of a house in gold was about the same as the equivalent in gold today.

If you took a time machine from then, to now, with a pocket full of gold, it would translate remarkably well into being able to buy the same amount of goods.

Learn EVERYTHING you need to know about

buying, owning, storing and investing in gold & silver…

Download our FREE precious metals report and learn…

This 50-page report is brand new and absolutely free.

Productive land is another classic value store. That doesn’t mean it never loses value. But people have to eat, and there is a limited supply of land. So it’s pretty safe to say good farmland will always be worth something.

Read on to discover many other places to park your wealth, to maintain or grow its value.

Store of value options to consider:

As we’ve discussed, the function of money is not a store of value, but to facilitate trade.

When it was backed by gold, dollars were also a store of value. But that is no longer the case, because dollars lose value every year due to inflation.

You are basically guaranteed to lose at least 2% of the value of every dollar you save, every single year.

But now governments and central banks are setting us up for a scenario where inflation could go through the roof.

That is why it makes sense to spread your wealth out among different stores of value, as a form of savings, outside the monetary system.

We’ll start with the most obvious value store, that has literally been around since the dawn of civilization.

How did you like this article?

Click one of the stars to add your vote...

Other readers gave this article an average rating of 4.6 stars.

Gold may be the best way to store wealth.

It is the ultimate insurance plan. And you don’t have to know exactly what will happen next to benefit from the insurance.

Gold protects you against inflation and money manipulation. It keeps your money out of the hands of the bankers who invest it in risky financial schemes.

Plus there is a 5,000 year history of using gold as a store of value.

Buy Gold and Silver and Store it in a Home Safe

To prepare for the worst case scenario you will want at least some of your precious metals at home, so you could use them as money if things really deteriorate rapidly.

That could mean a total loss in faith of the US dollar, causing hyperinflation. Or it could mean an all out war, in which the financial and trade systems shut down.

There are plenty of scenarios where you want to be close to your precious metals, because you will need to actually use them as money, to buy food, or trade for other goods.

This is also a good reason to keep some gold and silver in smaller denominations. If you’re trying to buy a week’s worth of food, you don’t want to have to trade your one ounce ( about $2,000) gold coin. Better to have some one ounce (about $30) silver coins on hand.

The dollar is not necessarily on the brink of a collapse today, but if COVID-19 has taught us anything it is that ANYTHING is possible, even things you could never imagine.

But one of the best things about storing gold and silver in a home safe, is that it has ZERO counterparty risk.

Counterparty risk is when you have to rely on another party to access your capital. When you deposit cash at the bank, it stops being your money. It becomes the bank’s money.

You are just an unsecured lender, who the bank owes money to. But if the bank is reckless with it’s finances and goes under (as many banks have in 2008), then it simply won’t be able to honor your deposit.

But when you own real, physical gold and silver then you have no other counterparty to rely on.

When you store precious metals at home, in your own safe, you don’t have to rely on a storage facility, a bank, or other intermediary to access it. You have it when you need it.

But it does mean you will want a strong home safe. How to determine if a safe is robust enough is something we cover in our free Ultimate Gold and Silver Guide.

For home storage, gold coins generally make more sense than gold bars, since they come in smaller denominations.

That makes it easier to buy or sell (or even spend) smaller amounts at one time.

And you also benefit from buying coins which are easily recognized.

A Canadian Maple Leaf is the world’s most popular and recognized gold coin. You’ll likely easily find a buyer no matter where in the world you are.

Buy Gold and Silver and Store it Overseas

Storing gold overseas clearly holds more counterparty risk– but there’s a different objective.

In the past, the US government, under Franklin D. Roosevelt, actually outlawed private gold ownership.

Even if that seems unlikely, frivolous lawsuits from people desperate for money are not. In tough economic times, the lawyers come out of the woodwork. You will want some of your assets safely out of reach of the US court system, in a jurisdiction which respects your property.

And then there’s the rioting and looting. If you’ve seen the news lately, you know that not even police stations or gated communities are safe from destruction.

So depending on your situation, it may be safest to keep your precious metals out of reach.

For asset protection purposes, and for the ability to hedge against what might happen– or is happening– in your country, it makes sense to send a portion of your savings overseas, to a secure storage facility, in the form of bullion bars.

Storing gold overseas is legal, and it keeps a portion of your savings safe and secure.

Bars make sense when stored offshore, simply because they are more compact and make storage easier and cheaper.

One great option is in Singapore. They have one of the best security systems in the world… and they also let you do peer-to-peer lending or borrowing based on gold instead of on paper (fiat) currencies.

So you could actually borrow against your own gold holdings, and as long as you pay the loan back, your gold remains yours.

The fact that Singapore is a relatively safe jurisdiction with a wealthy government makes it that much better.

We cover this storage facility and their precious metals based peer-to-peer lending platform in more detail in our free Ultimate Gold and Silver Guide.

Learn EVERYTHING you need to know about

buying, owning, storing and investing in gold & silver…

Download our FREE precious metals report and learn…

This 50-page report is brand new and absolutely free.

In the USA, gun sales keep setting records.

FBI firearm checks have been going through the roof, and each one of these represents another buyer of weapons and ammo.

March 2020 set a record with 3.7 million FBI firearm background checks.

And then June 2020 set ANOTHER record with 3.9 million checks.

Based on this metric, five of the top ten days for firearm sales since the system began in 1998 have been in 2020.

All this to say, firearms are in high demand. And that means not just new, but used firearms are highly valuable right now.

And as riots, violence, and politically instability increases, so will demand for firearms. They are especially useful in a worst case scenario of total lawlessness and a breakdown of social order– for protection, for hunting, and for barter.

Plus, unlike vehicles, for instance, firearms can easily maintain their value with a little basic maintenance.

Ammunition has also been rising in demand and sales, and therefore prices.

But ammunition is a little tougher to use as a store of value since it does “go bad” or lose potency over time.

That said, modern ammunition should last at least ten years, and potentially MUCH longer if stored in the proper conditions.

So while it may not be something to hand down to the grandkids, it can certainly maintain value over time.

To make sure you have good resale value on your firearms and ammunition, you will want to acquire well recognized in-demand calibers and brands.

The AR-15, for example, is a firearm design, originally created by ArmaLite, but now produced by a number of different manufactures.

It is generally chambered in .223 caliber ammunition.

And because of the popularily, it is a safe bet that AR-15s and .223 ammo will hold value.

But this is far from the only well-recognized firearm and ammunition. You’ll have to decide for yourself the best option for your circumstances and budget.

Government restrictions can also increase the value of certain firearms and accessories.

For example, some states have banned large capacity magazines which hold more than ten rounds of ammunition. But they make an exception for pre-ban magazines, manufactured before the ban went into effect.

These magazines will only grow in value, as there is a limited supply.

How did you like this article?

Click one of the stars to add your vote...

Other readers gave this article an average rating of 4.6 stars.

Then there are collectible firearms in several categories.

Collectible firearms include guns from various wars, the westernstyle market, the ultra-high-end market and antique firearms (defined as those weapons manufactured before 1899).

Gun aficionados have collections well into the six figures. A lot of guns trade at auction, at gun shows and privately.

Before buying, you’ll need to do your homework.

Check your state and country’s gun laws. (Under US federal law, antique firearms are generally outside of federal jurisdiction).

Be suspicious about private sellers – especially online sellers – without a solid reputation. And ensure the manufacturer and/or style of gun will stand the test of time, so there will be a market if you want to sell in the future.

Many military gun collectors will often specialize in a period. There are collectors from the World Wars.

Some specialize in Nazi collections, but 9 out of 10 people aren’t fans of collectible guns and 9 out of 10 collectible gun owners hate Nazi memorabilia. So, I advise caution for this tiny market.

Other collectors specialize in the Vietnam War, Revolutionary War or Civil War.

Some firearm collectors are loyal to brands, like the western gun market of Winchesters and Colts. A Winchester Model 21 in 16 or 20-gauge can easily run over $25,000 for example.

As we’ll discuss with some other assets in our collectibles section, go with where your interest lies. That way the research– which should be extensive before investing in a store of value like collectibles — is fun.

Agricultural Property

Real, productive assets like farmland make a lot of sense as we face a variety of economic scenarios in the post COVID-19 world.

Agriculture is an excellent asset class, especially now, when the macro fundamentals of food demand is increasing, while the supply of arable farmland is decreasing.

At the end of the day, everybody always needs to eat, no matter what’s happening in the world.

Plus, in an attempt to boost economies, central banks are currently cranking their printing presses into overdrive. Not only might these actions not boost anything, they could end up devaluing currencies.

Central bankers haven’t yet found a way to print real assets like productive agricultural land, commodities, precious metals, etc. And this is where you can find and create significant opportunities in the coming years and decades.

However, keep in mind that purchasing agricultural property is very different from placing a portion of your wealth into precious metals.

Gold is more of an absentee asset– you can simply buy it and store it, and you don’t have to think too much about your gold or devote much time to it.

Farmland requires time and ongoing capital investments. And to have a productive farm, the operations are best left to professionals.

Also, you should treat a farm as a business. And like any business, to be successful, you need a great management team and the ability to scale operations.

If you own a property of 10 acres, you will not make enough money to hire a team of professional managers. But if you acquire 1,000 — or even better, 5,000 acres — you’ll have the scale to hire top industry talent.

So again, just like any business, productive agricultural properties generally require professional management and scale.

The exception here, of course, is when you are just looking to homestead, i.e. growing food, etc. for your own personal needs.

In this case, depending on how much livestock you want, a 5-10 acre property should do the job (and sometimes even smaller properties might work).

As for some of the best places, I still think that Latin America wins over most other regions. In Latin America, you can actually own the land, which is typically not possible in South East Asia.

Also, the land itself is much cheaper than, say, in California or Western Europe. And there you have favorable weather, which allows you to grow a variety of different foods. I personally like Chile, especially for smaller, personal homesteads.

In California, depending on what part of the state you’re in, you might pay $30,000 or more for an acre of arable land.

But you could purchase an acre in Chile for about $5,000. Chile has great weather, plenty of water, and nutrient-dense soil. Certain types of produce – for example, berries, fruits, nuts, and grains – flourish there.

It’s very much like California in that regard, so you could indeed grow quite a lot of your own food. In fact, Chile is great for both smaller homestead options as well as larger scale agricultural businesses.

For personal homesteads where financial returns are not a factor, Ecuador is another option to consider.

Few asset classes are as inflation-proof as high quality productive land… because, no matter what, it will always have value. Human beings will always need to eat.

Farmland prices around the world have been rising rapidly over the years and have hit all-time highs in places like the US and UK. But farmland in Chile, Uruguay, Paraguay, and select other markets is still quite reasonable.

Like anything, you wouldn’t want to hold any of these assets without first educating yourself and becoming an informed owner.

But given that the paper currency sitting in your bank account is depreciating rapidly… or at best, generating a tiny fraction of a percent in interest, it’s definitely worth looking into alternatives right away.

Collectibles

Collectibles are a good store of value because of their scarcity and desirability.

That means they need to have a wide enough appeal for there to be a market to sell them in. And it means the supply has to be limited enough so that their ownership has some level of exclusivity.

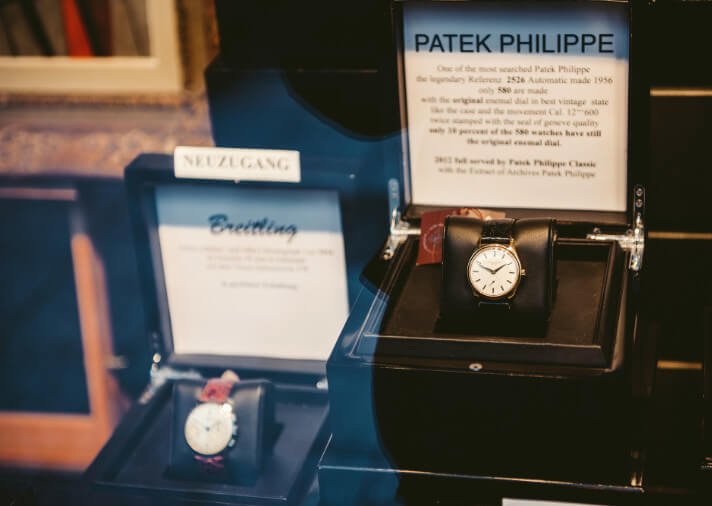

Let’s start with watches… you can probably guess at least one of the two main brands that are the best store of value.

Watches

A single watch can be worth tens of thousands… even hundreds of thousands of dollars.

Imagine putting $200,000 on your wrist and leaving the country– it’s an easy way to move wealth.

As with most collectibles, scarcity drives prices higher in the watch market. Most watches are like cars, they depreciate. But scarce models (of cars, or watches… like a Patek Philippe) hold value.

High-end watches are assets which hold their value over time.

For example, a 1968 Rolex Daytona worn by actor Paul Newman sold for $17.75 million at auction in October 2017. That’s the highest price ever paid for a wristwatch at auction.

And in 1984, when Newman gifted the watch to his daughter’s boyfriend (who put it up for auction), the watch was selling for around $200.

The next highest auction price for a wristwatch was a Patek Philippe ref. 1518 which sold for $11 million.

People often wonder how a watch can cost into the millions.

It’s an engineering marvel. And they only make a few of them.

A master Swiss watchmaker works with hundreds of thousands of parts, staring through a microscope to assemble the watch. These countless pieces move in perfect precision together.

You can pick up a scarce, solid luxury watch (priced around $5,000 and up) or even a more scarce, ultra-high-end collectible.

Whatever your budget, the formula is simple: Stick with Patek Philippe and Rolex.

These are the two strongest and most desired watch brands out there. And they bring the highest prices at auction.

The high-end watch market has a good core set of collectors.

And most people who buy them never sell them. They don’t need the money and would rather own the watch.

A luxury watch is a built-in Plan B. If you’re wearing a nice watch and find yourself in trouble, you’ve got barter currency on your wrist.

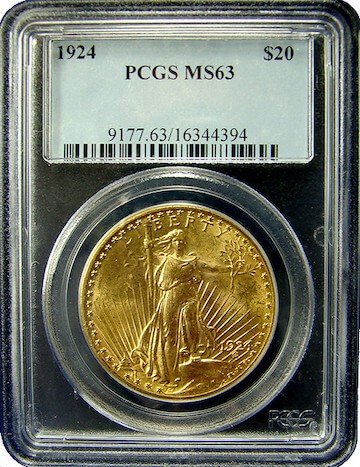

Coins

In 2020, the collectible coin market is on fire.

If you enter collectibles at the right time (when demand is much lower), you can find a deal.

But now’s not an ideal time to wade into collectibles. In the Spring of 2020, we talked to a renowned coin expert, the guy who literally created the standard for grading and pricing collectible coins.

Even early in the morning, his phone was ringing off the hook, with buyers desperately wanting numismatics– or collectible coins.

This increased demand has caused the premium on many collectible coins to rise.

And demand has remained high, along with premiums. In September 2020, the premium on a Mint State (MS) 65 $20 St. Gaudens gold piece from 1911 was about $1,200 above the spot price.

(Mint State coins are the highest quality numismatics, ranging from MS-60, one that is covered with marks, to MS-70, a flawless example.)

That’s a steep premium.

But when the time is right, collectible coins derive value from more than just their gold content. Like many collectibles, the value is based on rarity.

A famous example is the $20 Saint Gaudens “High Relief.”

The US Mint struck about 11,200 coins before it realized how difficult it was to force the gold deep into the die. It was nearly impossible to mint a coin that would be considered fully struck.

The original High Relief coins currently contain about $1,970 of actual gold value (as of this writing). But the higher quality versions of those coins have sold in the past year for $31,200 to $58,750.

Each year, the US mint cranks out more gold eagles and silver coins. The same applies to Canada, South Africa, Austria and other sovereigns.

But, King Alyattes of Sardis, Lydia (present day Turkey) will never fire up his 600 BC mint to crank out more gold and silver coins.

The price of regular bullion coins like eagles and maples from modern-day government mints is based on the current gold and silver price. But, rare coins derive their value based on supply and demand, along with some other factors.

One of the most important factors is the coin’s condition. Does it look brand new, or is it so worn out that you can hardly see the design? The condition can make a huge difference in price.

So, only buy coins that have been graded by professionals.

Since 1948, the Professional Coin Grading Service (PCGS) has graded rare coins on a scale of 1 to 70. A coin that is covered with several marks and scuffs might score 60, while one that’s flawless would score 70.

Every coin graded by PCGS is sealed in a plastic container that contains the grade and other important information.

It’s important to keep in mind that even though something like a rare coin is a great value store, it doesn’t mean you can always sell it for a profit, or even the same price you paid.

Value still fluctuates. But the point is that the asset will remain worth something, and likely eventually regain it’s value, as long as you are patient.

If you buy when an asset is in high demand, you will pay a steeper premium. If demand cools, you may have to wait longer for the price to bounce back.

Learn EVERYTHING you need to know about

buying, owning, storing and investing in gold & silver…

Download our FREE precious metals report and learn…

This 50-page report is brand new and absolutely free.

Artwork

In the year 1649 after nearly a decade of painstaking work, the legendary Dutch artist Rembrandt van Rijn put the finishing touches on one of his masterpieces: Christ Healing the Sick.

He sold the piece for a record-setting 100 Dutch guilders… an incomprehensible amount of money to pay for art at the time.

A lot of people probably thought the buyer was crazy for paying such a high price.

But the masterpiece was passed down through the generations for more than 200 years. And when it came up for sale again in 1867, it was purchased for the equivalent of nearly 12,000 Dutch guilders… more than 100x the original price paid in 1649.

Rembrandt paintings don’t change hands too often these days; in fact there are only three of his works that are still privately owned.

One of those three came up for auction at Sotheby’s in July 2020, and fetched north of 16 million euros.

Now, the Dutch guilder doesn’t exist anymore– it was replaced by the euro in 1999 at a rate of just over 2.2 guilders per euro.

16 million euros would have been the equivalent of more than 35 million Dutch guilders (based on the final exchange rate in 1999 when the guilder was replaced by the euro).

You might be thinking– “That seems like a phenomenal return on investment– from 100 to 12,000 to 35+ million.”

In fact it is a modest 3.5% per year. But it’s been compounded annually over the past 371 years.

Once again, it comes down to scarcity, and desirability. It is scarce because Rembrandt won’t be painting any more. And it is desired because people know who Rembrandt is, and admire his work.

But you don’t need to spend this kind of money for art to be a useful store of value.

A more affordable, but still valuable, artist, for example is John Severson. He founded Surfer Magazine and was a longtime champion of the sport.

Severson passed in May 2017. Some of his artwork is in the $10-$20,000 range.

And still, art can be a good store of value even into the hundreds of dollars range.

We suggest you buy what you love. Simply find an artist and style that appeals to you, and look around, even on Ebay, for some of his or her artwork.

Storing your collectibles…

Keep in mind that there will be costs to storing collectibles in the proper environment.

The older a painting is, for example, the more care it needs to control for things like moisture and sunlight.

Firearms too need to be properly looked after to prevent rusting.

And the most expensive items will need insurance.

You should consider these costs in your calculations when deciding on what to purchase to store value.

Of course you want to buy artists’ work that at least some people recognize so that there is a market for their work.

Here are some other tips for buying artwork as a store of value:

And remember the longevity of quality art. The da Vinci which fetched the highest price ever for art at auction — Salvator Mundi for over $450 million in 2017 — is from six centuries ago. These assets can maintain and even grow in value for a long, long time.

If all your money is tied up in the financial system, the power game is rigged against you.

This is true of the heavily indebted government, the bankers gambling with your money, and the Federal Reserve that steals value from your savings with every dollar it prints.

If you want your hard earned wealth to maintain its value, exchange some of those dollars for real assets that are an actual store of value.

And don’t just limit yourself to the assets we discussed here.

Whatever your area of expertise or interest, you can likely find something valuable– from fine wine, to baseball cards, to rare books.

Just remember the main aspects we discussed which make an asset function as a store of value– things like desirability, exclusivity, and longevity.

But finding great stores of value to protect your wealth is only one aspect of taking back control over your life.

Sadly 2020 may only be a preview of the things to come. From government overreach, riots, looting, lockdowns, travel restrictions, and disastrous monetary policy– it’s hard to imagine things getting much better anytime soon.

But there is always another step you can take to stay one step ahead of the chaos and control.

Second passports to give yourself another option to live, work, and invest outside of your home country. Tax incentives to legally keep as much of your hard earned money as possible. Even homeschooling and homesteading can give you more control over your life.

Here are some of our best free resources to explore:

Learn EVERYTHING you need to know about

buying, owning, storing and investing in gold & silver…

Download our FREE precious metals report and learn…

Inside we have premium intelligence on how to get a valuable second passport (potentially for free), foreign banking, options to reduce, defer, or even eliminate your taxes, to incredible investment picks outside the mainstream and much more.

Join over 100,000 subscribers who receive our free Notes From the Field newsletter

where you’ll get real boots on the ground intelligence as we travel the world and seek out the best opportunities for our readers.

It’s free, it’s packed with information, and best of all, it’s short… there’s no verbose pontification here– we both have better things to do with our time.

And while I appreciate all the visitors who stop by our website, I provide special bonuses to our email subscribers… including free premium intelligence reports and other valuable content that I only share with them.

It’s definitely worth your while to sign-up, and if you don’t like it, you can unsubscribe at any time.

How did you like this article?

Click one of the stars to add your vote...

Other readers gave this article an average rating of 4.6 stars.