In many cases, when you open a bank account somewhere in the world, you’ll fill out countless documents. You’ll present your other existing bank account information.

The bank will have strict requirements for proof of address. You might wait for a couple of hours to open an account.

But in the Republic of Georgia, all this goes out the window…

In fact, one of the easiest offshore bank account experiences of my life happened in Georgia.

(This is telling. I’ve traveled to over 130 countries. I have multiple bank accounts worldwide. I even own my own bank.)

You can stroll into a Georgian bank with your passport and very little money. (Currently, the minimum deposit at one bank is only 10 Georgian lari – about US$3.25.)

And that’s it. You’re on your way to an offshore bank account… likely in less than half an hour.

Bank officials will ask you for an address. But they won’t ask for proof. You might find that the bank’s system can’t handle an address that’s different from your passport.

So, if you’re an American living in Thailand, the bank employee will ask you for a US address. In this case, an address of your relatives living in the US will work – again, there’s no check.

(Americans – you’re still on the hook for US government reporting, no matter where you live. If the total value of your foreign financial accounts exceeds $10,000 at any time during the calendar year, you must fill out FinCEN 114 – the Report of Foreign Bank and Financial Accounts (FBAR).

Also, depending on your marital and residency status, you may have to also file an IRS Form 8938, which is the Foreign Account Tax Compliance Act (FATCA) reporting form.)

But while the opening procedure is simple, traveling to Georgia – one of the safest and least corrupt countries in the world – is more involved.

Georgia is a small country, and you’ll have a couple of layovers before landing there. And when you finally land, it could be at 3:00AM – a common arrival time for international flights.

But you may find that the trip is well worth it.

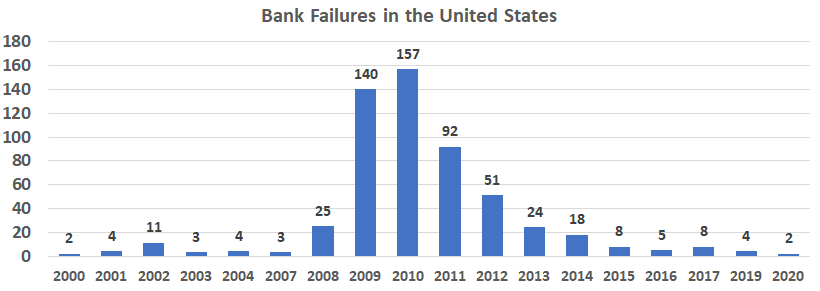

On top of an easy account opening experience, Georgia’s banking sector has been safe.

Total deposits across the banking sector – when compared to the country’s GDP – are low, making it possible to bail out Georgia’s banks, if needed.

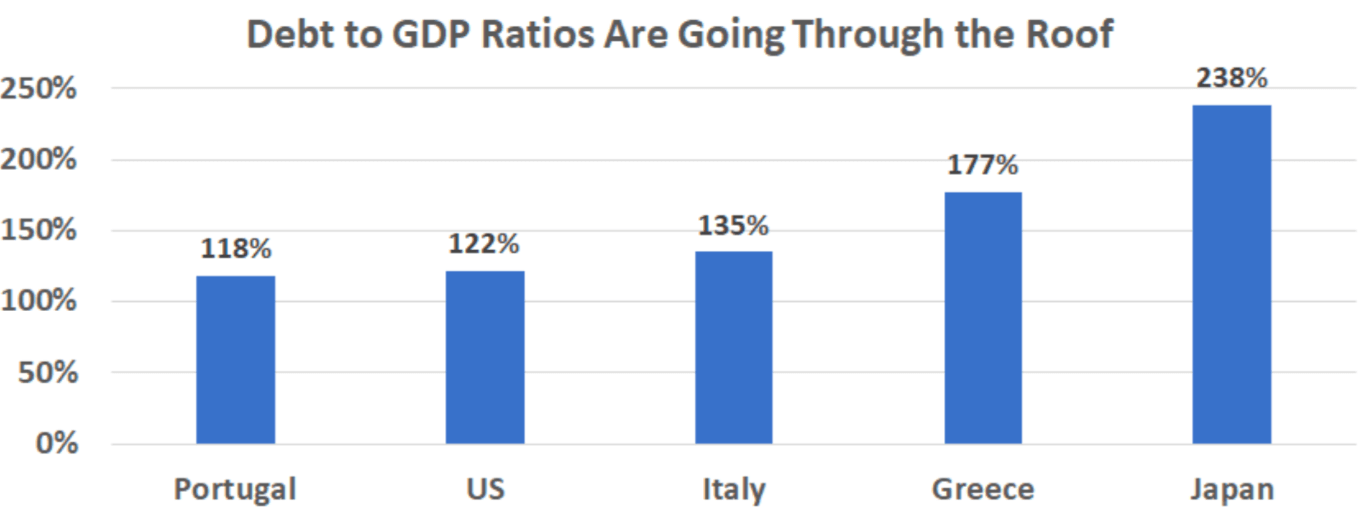

Both Georgia’s government and its central bank are solvent. A debt-to-Gross Domestic Product (GDP) ratio of 41.3% for the latest fiscal year indicates that the country’s debt level is manageable.

Georgia’s central bank solvency is 19.6%, which is a good margin of safety.

Note that Georgia only has a small amount of deposit insurance protection – 15,000 Georgian lari, or about US$5,000. So if your Georgian bank fails, you can indeed lose your deposit over this amount…. unless the government bails out the bank.

In the past several years, Georgia has been a stable banking jurisdiction. And we’ve been confident in the Georgian banking system.

But COVID-19 changed everything… and we won’t know any more information about Georgia’s banks until their comprehensive annual reports are released in early 2021.