The Ultimate Guide To Retirement Planning & IRA Accounts 2024

-

PUBLISHED

May 7, 2024

The socialists are not coming, they’re already here… And your retirement savings are at risk. Discover what you can do to protect and maximize your retirement savings in 2024 and beyond with our Ultimate Guide To Retirement Planning and IRA accounts.

Socialism is on the rise, in the US and the world. Are you worried how this alarming trend and their massive spending programs will affect your retirement savings? If so, then it makes sense to do everything you can to protect your hard-earned cash.

No one else is going to safeguard your retirement account — it’s all on you. But there are sensible steps you can take to secure your retirement savings and optimize your tax situation before it’s too late.

In this guide, we’ll explain how you can take charge of your retirement savings — with better structural protection, alternatives to fiat currency, and more lucrative investment options.

You’ll also learn more about the features and benefits of 401(k)s, Roth vs Traditional IRAs, and why you seriously need to look at Self-Directed Retirement Accounts.

So let’s got to it…

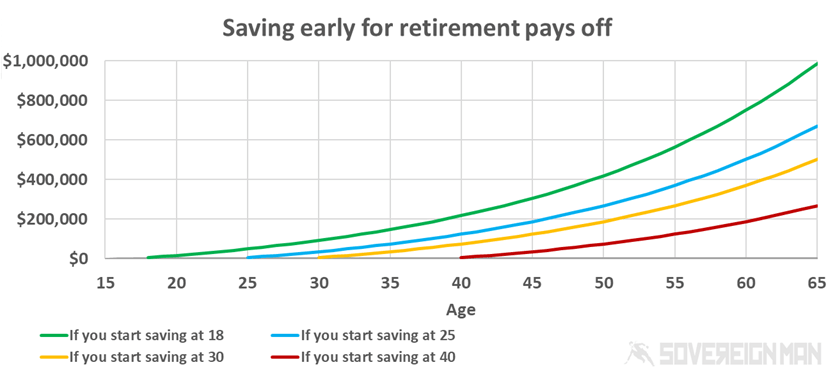

Albert Einstein is rumored to have said that “Compound interest is the eighth wonder of the world. He who understands it, earns it … he who doesn’t … pays it.”

Never underestimate the power of compound interest. Even small amounts compounded over long periods of time can really add up.

Here’s an illustration of how powerful it is…

(Assumptions: $5,000 invested each year, growing at 5% annually.)

If you start investing at the age of 18, and following the assumptions above, you’ll have nearly $1 million when you’re ready to retire at age 65. But if you wait until you’re 40, you’ve lost precious time for interest to compound. By age 65, you would only have $267,500 — about a quarter of the amount as the individual who started saving for retirement at 18 years old.

With that said, don’t consider the following as financial advice. We don’t know your unique circumstances, your comfort with risks, etc.

But we can provide general commentary on what MAY be the best retirement account for you, based on your age and your reason for investing.

| How old are you? | Why are you investing? | Possible retirement structure to consider* | Additional notes & other considerations |

| 18-25 year olds | You want tax-deferred, long-term growth. | Traditional IRA or 401(k) | If you plan to retire at age 65, you have 40+ years to invest in assets with tax-deferred funds. |

|---|---|---|---|

| 26-35 year olds | You’re earning more and want to reduce your taxable income plus save for retirement. | Traditional IRA or 401(k) |

A Self-Directed IRA LLC -- structured either as a Roth IRA (post-tax funds) or Traditional IRA (pre-tax funds) -- opens asset classes not allowed in an employer-sponsored 401(k), for example. Cryptocurrencies, precious metals, real estate, private businesses and more are all investment opportunities within a Self-Directed IRA LLC. |

| You’d like to maximize your future retirement account distributions (which will be tax-free). | Roth IRA | ||

| You’re pursuing growth in assets that can potentially produce outsized returns (and you understand the risks). | Self-Directed IRA LLC (Roth or Traditional) | ||

| 36-45 year olds | Your earnings are growing further and you’d like to reduce your taxable income. | Traditional IRA or 401(k) | |

| You have the capital (and know-how) to invest in asset classes other than stocks and bonds. | Self-Directed IRA LLC (Roth or Traditional) | ||

| 46-54 year olds | You’re in your prime earning years, and you need to reduce your taxable income. | Traditional IRA or 401(k) |

As you look ahead to retiring at age 65 (10 to 20 years from now), with a Traditional IRA or 401(k) you can plan for the future tax impact of required minimum distributions (RMDs). Unlike other retirement structures, Roths do NOT require you to take RMDs. So, you can consider rolling over some funds to a Roth or opening a Self-Directed Roth IRA LLC. |

| You have the capital (and know-how) to invest in asset classes other than stocks and bonds. And with retirement approaching, you’ve carefully considered the risks in doing so. | Self-Directed IRA LLC (Roth or Traditional) | ||

| 55 or over | You want to mitigate higher taxes that may come in the next decade -- as a result of higher earnings and/or changing tax policy. | Roth IRA |

The 2019 SECURE Act eliminated the “Stretch” component for those who inherit IRA funds. Before, if your child or grandchild was young and inherited an IRA from you, they could stretch the RMDs over their lifespan. (RMDs are classified by the IRS as ordinary income.) But with decades remaining in their life, all but the most wealthy IRA inheritances wouldn’t significantly impact his or her tax liability. That was before the SECURE Act was passed in December 2019. Now, with the stretch provision gone, unless your beneficiary is in a few categories, they must take 100% of RMDs from inherited IRAs within a 10-year span. Using a Roth IRA (or rolling over to one once you reach age 72) will let you pass on the account with the most growth in it. |

| You want to maximize your children or grandchildren’s inheritance. |

Roth IRA OR Self-Directed Roth IRA LLC |

* NOTE: Again, this is simply a presentation of potential retirement structure options, not investment advice. You’ll need to carefully consider your unique situation, the potential for alternative asset allocations, tolerance for risk, etc. And consult with a trusted financial advisor before opening a retirement account.

Take Back Control Of Your Retirement Savings Today.

Don’t let the stock market hold your retirement savings hostage – discover two powerful tools to help you take back control and invest in REAL assets in 2022!

In this report…

In this section you'll learn more about:

If you’re an employee of a US company, you may be offered a 401(k), 403(b), 457, or a few others (all of which are similar from the employee perspective).

These commonly allow Traditional (pre-tax) or Roth (after-tax) contributions and have different levels of employer matching, profit sharing, and the like.

Yet the best IRAs to consider will ultimate depend on your unique situation.

Here’s a summary of these options…

In 1978, Congress added a new provision — the 401(k) section — within that year’s Revenue Act.

Passage of this bill into law immediately altered the Internal Revenue Code. Employees were allowed to avoid taxes on deferred compensation. In 1981, the IRS ruled that employees could fund their 401(k) using automatic (pre-tax) payroll deductions.

So, starting in the 1980s, employer-provided “defined benefit” pension plans were increasingly replaced by “defined contribution” 401(k)s.

“Defined benefit” versus “defined contribution”

Let’s briefly distinguish between these two terms.

As the name suggests, “defined benefit” is just that: you contribute money throughout your working years to a pension plan, and when you retire, you receive a defined benefit or distribution annually. The onus is on the employer’s pension plan administrator to ensure that the money you invest is safeguarded and that you’re receiving your defined benefit.

“Defined contribution” shifts the responsibility away from the employer and the employer’s pension plan administrator. Instead, the responsibility for retirement planning and investing is placed squarely on the shoulders of the employee.

Again, as the name suggests, you contribute money throughout your working years, but when you retire, you receive a “defined contribution.” This is based on how much you contributed (with potentially employer-matched funds) and the performance of the stocks, bonds, etc. that you own.

It seemed like a win-win: Companies benefited from the cost savings of a defined benefit plan. And for employees, a 401(k) was a new way to save for retirement.

The strategy was (and still is) to forgo taxation now — while in the workforce and taxed at a higher tax bracket — in favor of being taxed later. Because once retired, without a steady income from a job or dividends, many people enter a lower tax bracket.

And once you’re retired, you’re required to start taking minimum distributions, which again will be taxed.

Required Minimum Distributions (RMDs): You’re required to take this amount of money out of your 401(k) once you reach age 72. You can start taking optional RMDs from as early as 59.5 years old.

You’ll be taxed on those distributions. The amount you must take out is tied to the value of the account at the end of the previous year. You’ll pay taxes based on your tax bracket for the year in which you make a withdrawal.

Your RMDs are required to be taken by December 31st of each year. And these are based on actuarial lifespan tables. With each passing year, you’re less likely to see another year, so your annual RMDs will increase.

Once you start taking RMDs, the IRS considers these distributions to be ordinary income.

Ordinary Income: The IRS considers wages, salaries, tips, bonuses, royalties, interest income from bonds, etc. to be ordinary income. (Capital gains, such as profit from the sale of a house, generally are not considered ordinary income.)

Ordinary income is taxed at a range of rates in the US, based on your income level.

Today, employer-sponsored 401(k) plans are ubiquitous. They’re easy for employees to start, and are a simple, hands-off way to invest for retirement.

But the benefits end there.

While an employer-sponsored 401(k) lets you invest in the market, this retirement structure often limits your investment choices to a handful of funds — from extremely conservative (low risk/low return) to more volatile (high risk/high return).

There’s no low risk/high return option; the kind of option we prefer at Schiff Sovereign.

Instead, the 401(k) options are bold enough to supposedly “predict” the future. You’ll see the “2040 Retirement Plan” or “2050 Retirement Plan”… as if fund managers can accurately predict interest rates and credit cycles. DECADES in advance. Either they can execute on this monumental task, or they’re more concerned about collecting fees from the “assets under management” (AUM).

We’ll let you decide which case is more likely…

For those of us not in possession of a crystal ball, other retirement plan options should be in demand. One such option is a Solo 401(k).

If you’re self-employed (including operating a solopreneur business) or a freelancer, you’re eligible for a Solo 401(k) (also referred to as a Self-Employed 401k). Solo 401(k)s are even suitable for people who have a side hustle, such as driving for Uber or renting rooms on Airbnb.

A Solo 401(k) offers several benefits:

How the SECURE Act impacted retirement plans

Passed in late December 2019, there were several provisions in the Setting Every Community Up for Retirement Enhancement Act (SECURE Act) that affected retirement plans.

In Sovereign Confidential, we wrote a comprehensive Alert that covered how this legislation specifically impacts employees, business owners and freelancers with various retirement structures — a Traditional 401(k), Solo 401(k), Self-employed Pension (SEP) IRA, etc. We cited several examples throughout, so one is likely to be relevant to your own situation.

If you’re a Confidential subscriber, click here to access this SMC Alert.

Individual Retirement Arrangements (IRAs) were established by the 1974 Employee Retirement Income Security Act (ERISA).

And seven years later, IRAs gained popularity under the Economic Recovery Tax Act of 1981, which allowed working taxpayers to open IRAs.

In a typical IRA, you’ll make periodic contributions from your paycheck or savings.

Those funds are often deposited with a large financial institution known as the IRA custodian, such as Vanguard or Fidelity — two of the largest IRA custodians in the US. IRA custodians will typically offer a menu of mutual funds to choose from.

You could also establish an ordinary IRA account with a large brokerage firm such as Charles Schwab or E*Trade. In that case, you’re picking the stocks or bonds yourself.

Like employer-sponsored 401(k)s, IRAs are simple and easy to set up.

However, as with 401(k)s, that can be a disadvantage for more savvy investors. You’re limited to certain asset classes — again, namely publicly traded securities such as stocks, bonds and mutual funds.

Although you won’t gain access to other asset classes like real estate and precious metals, if you’re a business owner, you can pursue other IRA structures…

Your first option is a Simplified Employee Pension (SEP) IRA. A SEP doesn’t have the start-up and operating costs of a conventional retirement plan, and allows for a contribution of up to 25% of each employee’s pay.

SEPs only permit these employer contributions, not individual contributions. And for employees to qualify, they must:

Another option is a Savings Incentive Match Plan for Employees, or SIMPLE IRA.

A SIMPLE IRA allows people with self-employment income to put ALL of their net earnings — net of the 15% self-employment tax — into a tax-deferred retirement account. For 2024, the exact annual contribution limit is $19,500 per year for those 50 and older, and $16,500 if you’re under 50.

In order to meaningfully compare the Traditional and Roth IRA advantages, it is useful to have a clear understanding of how each of these IRA accounts work.

Traditional IRAs allow you to contribute pre-tax dollars to fund your retirement.

As with the Traditional 401(k) we discussed above, if you invest money in a Traditional IRA, you’re taking advantage of the difference in tax brackets, now versus in the future. You’re deliberately acting to defer taxes today in exchange for paying taxes years or decades from now, when you’re retired and likely in a lower tax bracket.

Funds in a Traditional IRA can grow tax-free for decades, until you’re ready to start taking annual required minimum distributions (RMDs).

As we wrote in the 401(k) section above, RMDs — withdrawals from your retirement account — are required once you reach age 72. You always have the choice to start taking optional RMDs when you’re 59.5 years old.

The amount you must withdraw is tied to the value of the account at the end of the previous year.

For Traditional IRA account holders, you’ll be taxed on those annual distributions. And you’ll pay taxes based on your tax bracket for the year in which you make a withdrawal.

You must take RMDs by December 31st of each year. And the amount you take is based on actuarial lifespan tables. As you get older, your annual RMDs will increase.

The IRS considers RMDs to be ordinary income.

Let’s briefly discuss what the IRS means by “ordinary income”…

According to the Internal Revenue Code, ordinary income includes wages, salaries, tips, bonuses, royalties and interest income from bonds.

(Profits from the sale of a house and on publicly traded securities held longer than one year are taxed as capital gains, at a lower rate than one’s commensurate ordinary income tax bracket.)

RMDs are tied to the value of the account at the end of the previous year. So, if you had a banner year of performance within your Traditional IRA, your RMDs could markedly increase your income the following year.

If you’d prefer to pay tax up-front, you can turn to a Roth IRA.

In a Roth IRA, you contribute post-tax dollars towards your retirement savings.

Post-tax contributions mean that you will not obtain any tax breaks today when contributing to a Roth IRA. But… any future growth and distributions from the account will be tax-free.

There are some rules around how much you can contribute to a Roth account every year. In essence, the best Roth IRA accounts to look at will depend on your specific situation.

First, you have to take a look at your AGI — your Adjusted Growth Income.

Adjusted Growth Income (AGI): AGI is your gross income — wages, dividends, alimony, capital gains, business income, retirement distributions and other income — minus payments you made that year to things such as student loan interest, contributions to a health savings account, etc.

Modified AGI (MAGI) is AGI plus a few adjustments (student loan interest deductions, Foreign Earned Income and Housing exclusions, which we’ll mention below, etc.). In the simplest terms, you arrive at MAGI by taking your AGI and adding back in any tax-exempt interest income. For many people, their AGI and MAGI amounts will be close.

In 2024, those who are married filing jointly and have less than $240,000 in modified AGI can contribute an annual maximum of $6,000 ($7,000 if you are 50 or older). If your modified AGI is less than $240,000, you can still contribute to a Roth IRA, but at a reduced rate.

Or if you’re single, filing as “head of household,” or married but filing separately (and did not live with your spouse at any time in 2023), a Modified AGI of less than $153,000 qualifies you for the maximum annual contributions. Again, like above, you can contribute a reduced amount if your annual modified AGI is equal to or above $125,000, but less than $153,000.

So, if you qualify for Roth IRA contributions, using a Roth IRA account (or rolling over to one once you reach the age of 72) will let you pass on the account with the most growth in it. Because a Roth IRA is the only retirement vehicle that doesn’t require that you take RMDs, and no RMDs means a growing account balance.

For this reason, some investors will make contributions to a Traditional IRA and then convert that structure into a Roth IRA at age 72.

Others choose to make contributions to both a Traditional and Roth IRA all along during their careers. This way, they’re combining today’s tax benefits of a Traditional IRA with tomorrow’s tax benefits of a Roth IRA.

Before you consider to rollover your 401(k) to a Roth IRA, speak with a tax advisor familiar with your situation and that specializes in Roth IRA conversion.

Converting your Traditional IRA or 401(k) into a Roth IRA while living overseas

If you’re a Sovereign Confidential subscriber, we published a report on how to combine the up-front, tax-free benefits of a Traditional IRA or 401(k) with the subsequent tax-free benefits of a Roth IRA.

Sounds impossible, right? Well, it’s very possible — if you’re a US expat, that is.

In this Sovereign Confidential Alert, we provided step-by-step instructions (and a detailed example) on how to execute on this lucrative retirement strategy. Sovereign Confidential subscribers can also gain access to our trusted Roth IRA provider’s services. (We don’t receive any fees or commissions from this provider; we provide their details simply for subscribers’ benefit.)

If you want to wrestle back control from the socialist army that’s set on raising your taxes, and spending even more recklessly, thus causing greater devaluation of your savings, then there’s a strategy that you should consider…

Remember that we mentioned above that retirement accounts must have a custodian…

And that most custodians who administer standard retirement accounts — whether Traditional or Roth — are attached to a bank, stockbroker, mutual fund or an insurance company.

The custodian holds legal title to whatever is in your retirement account. They will steer you to a narrow menu of overvalued options such as stocks, bonds and mutual funds, etc.

Alternative asset classes — such as real estate or gold — might be attractive to you.

But under a standard custodian, if you want to invest in an apartment building or buy American Eagle gold coins, you’re out of luck.

You’re not completely out of luck, however…

Because you can still access those other asset classes in your IRA.

The way to do so is by establishing a Self-Directed IRA.

Just like the name implies, a Self-Directed IRA allows you yourself to direct what assets to include.

A Self-Directed IRA (or a Solo 401k) can be an incredibly powerful way to boost your retirement savings.

For a review of how to open a Self-Directed IRA, plus details on what you can and cannot invest in through it, please download our guide on Retirement Accounts.

Want debt-free startup capital and a flexible retirement structure? Consider a ROBS.

If you have existing retirement funds from, say, an employer-sponsored Traditional 401(k) and want to start a new business venture, consider a Rollover for Business Startups (ROBS).

A ROBS allows you to realize retirement account gains penalty-free and rollover (hence the name) these funds into a new retirement account structure. This way, you can also access debt-free startup capital for your business.

This benefit of debt-free startup capital alone is a compelling perk.

But it’s possible to have an even more lucrative structure — one with back-end tax benefits, too.

If you’re a Sovereign Confidential subscriber, we published a Sovereign Confidential Alert that specifies how to combine a ROBS with either an Opportunity Zone investment or a Puerto Rico Act 20 company. Sign in to your members’ area and access that Alert.

Or, if you’re not a Sovereign Confidential subscriber, we’ve assembled a preview of that Alert. You can access the shortened version here.

There may once have been a time to put your retirement planning on autopilot…

Like in the US of the mid-1980s — when a sense of optimism was in the air, when stocks were just starting a multi-decade bull run (and at much lower valuations than today), and when hard work, savings and capital were still valued and respected.

Plus, the nearest socialist movement that had any traction was thousands of miles from America’s shores.

But 2022 is a far cry from 1985.

Back in the 1980s, when the 10-year Treasury yield was 15%, a nest egg of $1 million invested in bonds gave you $150,000 in stable annual income. With interest rates on 10-year Treasurys at around 4% today, to achieve that same amount of annual income, you’d need a nest egg of $15 million.

And the fiscal and monetary situation likely isn’t improving any time soon…

The church of Wokeism occupies — and more importantly, increasingly controls — both chambers of Congress and the White House. And they’ve partnered with their friends at the Federal Reserve, ready to fix any problem or heal any ailment… by printing money.

A LOT of money.

In fiscal year 2020, before the socialists were in charge, the US federal government’s deficit was $3.1 trillion. In 2021, the deficit could easily grow to $5 trillion or more.

But politicians won’t just borrow and spend, which will reduce your future purchasing power. They’ll also likely raise your taxes. And there’s a good chance that besides the usual income tax hikes, they’ll also introduce a wealth tax.

(A wealth tax is a tax on your net worth, regardless of your income during the year. And the wealth tax won’t be just for those with $50 million or more in assets, as initially proposed by Senator Elizabeth Warren a couple of years ago.)

That one-two punch of printing money — with price inflation to follow soon after — and raising your taxes means that you’ll have to work harder than ever to maintain your standard of living. And if you want your money to last during retirement (possibly decades away), then you really need to start searching for higher-performing retirement solutions today.

Fortunately, there are still such options available.

You’re still in control of your retirement. You can open a flexible retirement structure. And you can own lucrative investment assets within this structure.

Retirement planning doesn’t require a lot of money. It requires rational thinking, the right information, and the will to take action.

To learn more about self-directed retirement accounts, and to take the next step, download our free report.

Take Back Control Of Your Retirement Savings Today.

Don’t let the stock market hold your retirement savings hostage – discover two powerful tools to help you take back control and invest in REAL assets in 2022!

In this report…

Legal Disclaimer:

Neither this document, nor any content presented by our organization, is intended to provide personal tax or financial advice. This information is intended to be used and must be used for information purposes only.

We are not investment or tax advisors, and this should not be considered advice. It is very important to do your own analysis before making any investment or employing any tax strategy. You should consider your own personal circumstances and speak with professional advisors before making any investment.

The information contained in this report is based on our own research, opinions, as well as representations made by company management. We believe the information presented in this report to be true and accurate at the time of publication but do not guarantee the accuracy of every statement, nor guarantee that the information will not change in the future.

It is important that you independently research any information that you wish to rely upon, whether for the purpose of making an investment or tax decision, or otherwise.

No content on the website (SovereignMan.com) or related sites, nor any content in this email, report, or related content, constitutes, nor should be understood as constituting, a recommendation to enter into any securities transactions or to engage in any of the investment strategies presented here, nor an offer of securities.

Sovereign Man employees, officers, and directors may participate in any investment described in this content when legally permissible, and do so on the same investment terms as subscribers. Sovereign Man employees, officers, or directors receive NO financial compensation from companies who appear in this report.

A self-directed Individual Retirement Account (IRA) is a specific type of individual retirement account that enables you to invest in asset classes that aren’t eligible under conventional IRAs.

Some of the asset types you can invest in with a self-directed IRA include real estate, cryptocurrency, and precious metals such as gold bullion bars and silver ingots.

Yes, self-directed IRAs typically have higher fee structures than conventional IRAs, and they tend to be more complex to manage. The benefits, however, can make the additional fees more than worth the while.

The maximum contribution to self-directed IRas, in 2021, is $6,000, or $7,000 if you’re over the age of 50 years.

There are two key benefits of a self-directed IRA over conventional IRAs. First, you can invest in higher-yield asset classes than is allowed within conventional IRAs, and second, you can diversify your portfolio with assets beyond traditional stocks and bonds.

When using a self-directed IRA, there are three potential risks to be aware of:

Join over 100,000 subscribers who receive our free Notes From the Field newsletter

where you’ll get real boots on the ground intelligence as we travel the world and seek out the best opportunities for our readers.

It’s free, it’s packed with information, and best of all, it’s short… there’s no verbose pontification here– we both have better things to do with our time.

And while I appreciate all the visitors who stop by our website, I provide special bonuses to our email subscribers… including free premium intelligence reports and other valuable content that I only share with them.

It’s definitely worth your while to sign-up, and if you don’t like it, you can unsubscribe at any time.

How did you like this article?

Click one of the stars to add your vote...

Other readers gave this article an average rating of 5 stars.