Spain Golden Visa Program 2023:

The Ultimate Guide

-

AUTHOR

Andre Bothma -

LAST UPDATED

January 5, 2022

Looking for a Plan B in one of the world’s most desirable locations? Offering world-class infrastructure, sumptuous cuisine and a leisurely pace of living, Spain is one of the world’s most sought after second home and retirement destinations – and with good reason.

The Iberian country truly offers it all. And for those with the means to invest in a Spanish Golden Visa, the benefits of EU residency can be obtained here with ease.

Find out more about Spain’s Golden Visa Program below, or simply complete the contact form to request a free consultation with a Spanish Golden Visa expert.

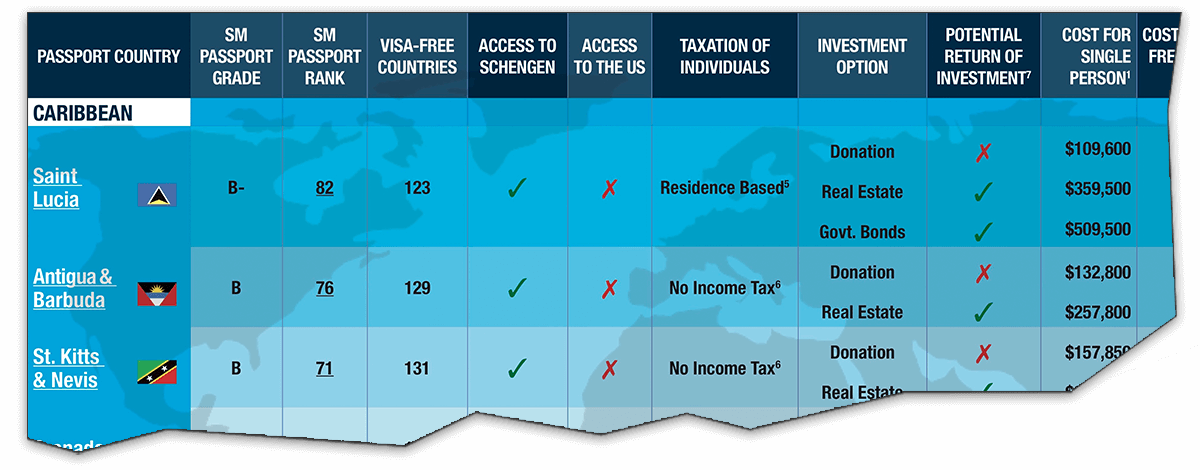

Compare ALL Citizenship-By-Investment Options At A Glance...

Download our Citizenship By Investment Comparison Sheet to see at a glance which options are right for you…

It could potentially help you save tens — or even hundreds of thousands — of Dollars by picking the best passport for your personal situation at the lowest price.

Inside, you’ll find…

Established in September 2013, the Spanish Golden Visa has long been one of the most popular programs of its kind in Europe. The program has raised in excess of €4.5 billion since inception. In fact, it raised over €500 million in the first quarter of 2020 alone, despite the impact of the Covid-19 pandemic.

The lion’s share of applicants hail from China, with countries like Russia, Iran and Saudi Arabia continually featuring in the Top Five list of applicant countries. As of 2019, however, the USA has entered into the Top Five source countries for the program, signaling a significant market shift as more Americans started seeking a Plan B for the first time.

The Spanish Golden Visa compares less favorably with those of Portugal and Greece in terms of property investment pricing, yet Spain’s sheer appeal as a second home and travel destination has seen market demand stay consistently high.

While approval volumes dropped somewhat during 2020 due to COVID-19, the impact on the Spanish program was far less pronounced than it was on the Greek Golden Visa.

Because essentially, applicants choose Spain because… it’s Spain.

Industry insiders have been lobbying the Spanish government to cut the investment requirement in half, to €250,000 (~$290,000) in the past year, but this has not happened to date.

LEGAL BASIS: Law 14/2013, gazetted on 27 September 2013, serves as the legal basis for an investor specific visa category allowing non-EU nationals to obtain Spanish residency by making an eligible investment of at least €500,000.

As of February 2021, foreign investors have the following investment options to choose from:

| Real estate investment | €500,000+ (~$607,000+) |

| Spanish government bonds | €2 million+ (~$2.4 million+) |

| Company investment (public or private) | €1 million+ (~$1.2 million+) |

| Spanish investment funds | €1 million+ (~$1.2 million+) |

| Local bank deposit | €1 million+ (~$1.2 million+) |

| Investment with significant socio-economic impact or scientific / technological value for Spain | Variable. |

Can Golden Visas in Spain be obtained retroactively?

Yes, this is a possibility. According to a prominent Spanish property publication, foreign nationals who bought a property in Spain for €500,000 or more, on or after September 28, 2013, may qualify to apply for a Spanish Golden Visa retroactively.

While the below list is not exhaustive, the following core application criteria apply as of February 2021:

According to Sovereign Man’s 2021 Passport Ranking Index, Spain is rated as an A-Grade travel document. The Spanish passport provides visa-free access to 161 countries worldwide, including the EU, UK, USA, Canada and Japan.

As we have reported elsewhere on the site, Golden Visa programs are an excellent choice if you are looking for a back-up plan, without the need to emigrate immediately or spend significant amounts of time in your new home country.

That’s because unlike with many other “regular” visas — like spousal or work visas — Golden Visas typically have negligible minimum in-country presence requirements, if any.

If you’re looking to actually emigrate and settle in Spain, however, the Non Lucrative Visa may be a better option, as no significant investment is required. The Portuguese D7 Visa may also be worth looking at if your plan is to relocate there, as it requires no mandatory investment either.

Whether you choose the Spanish Golden Visa over the Portuguese or Greek alternatives will also depend on whether you wish to naturalize and get a passport. If you just want to have an EU residency permit in your back pocket in case things were to go very wrong in your home country, Spain makes a lot of sense…

But if you’re wanting to get naturalized and become an EU citizen, Portugal offers a far shorter and less tricky path to do so. In Portugal, you can apply for citizenship after only five years of maintaining your legal residency.

Whereas in Spain, you’ll only become eligible to apply after 10+ years of holding legal residency. And you’ll need to be basically proficient in Spanish, with knowledge of the country’s culture and history, to become naturalized there…

And unlike in Portugal, you can’t just occasionally pop in for a few months at a time if you want to apply for citizenship. You’ll need to be present in Spain for an average of ten months per year throughout your residency period in order to qualify.

Unless you’re originally from a former Spanish colony, that is. Citizens of all of Spanish-speaking Latin America, as well as Brazil and the Philippines, can naturalize in Spain after holding residency for only two years.

And if you’re originally from one of the above-mentioned countries, you also won’t have to give up your native nationality and passport in order to become a Spanish citizen. (Everyone else is required to give up their native citizenship in order to become Spanish, as the country does not recognize dual citizenship.)

On the plus side, Spain does not enforce any minimum stay requirements. Whereas in Portugal you are required to spend, on average, one week per year in-country in order to maintain your residency status.

A word on Spanish taxation…

Another key aspect to consider is taxation. If you intend to spend more than 183 days per year in Spain, or even if your family were to live there without you, you’ll be deemed to become a local tax resident by the Spanish authorities.

And Spain is by no means a tax friendly destination. On an annual salary of €60,000 (~$70,000) per year, which is fairly moderate by North American standards, you will pay the top tax rate of 45%.

In addition, rental income derived from a Spanish investment property is taxed at a rate of 24%.

But given the appeal of the Spanish national brand, for many people acquiring citizenship tends to be a secondary consideration…

Brussels does not like Golden Visa and Citizenship By Investment programs one bit, and are actively seeking to shut them down. In fact, two of these EU programs, one in Cyprus and the other in Moldova, were recently shuttered due to pressure from the EU government.

Portugal has also just confirmed some significant changes to their Golden Visa Program, so it is clear that these programs may not be around forever. So, if you’re ready to activate this key part of your own Plan B, now is the time to take action to avoid missing out.

Simply complete the below form now to request a free consultation with a reputable Spanish immigration consultant.

Qualifying property investments priced from €500,000 excluding fees. Contact us now for more information.