Top 10 Countries offering retirement visas and residency without investment in 2023

-

AUTHOR

Andre Bothma -

LAST UPDATED

July 14, 2022

Looking to retire abroad in 2023? Discover ten of the most popular retirement visas, passive income visas and similar pensioner visa programs in the world below. While most of these programs are aimed at retirees with sufficient means to support themselves while living abroad, there are also a number of these programs that are open to applicants of all ages. Find out more below…

In this In-Depth Article...

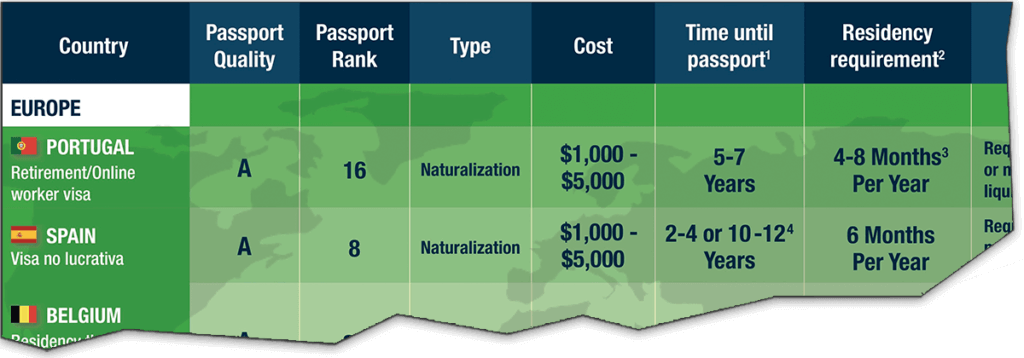

Download Our Free

Easiest Citizenship & Passport Comparison Sheet

Inside you’ll see all the options you have at a glance and find…

Looking forward to adding more red meat and Malbec to your retirement diet? Then a move to Argentina might be just the thing for you.

Whether you’re looking for that late-night city vibrance or a peaceful winelands existence, this beautiful and diverse South American country can deliver.

And if you’re earning dollars in your retirement, you can look forward to enjoying the finer things in life for substantially less.

Argentina is one of the countries in the world offering the fastest route to regular naturalization. You can become an Argentine citizen after only two years of holding legal residency there.

The Argentine passport is an excellent travel document, ranked 52nd in the world, with visa-free or visa on arrival access to 147 countries.

Visa-free destinations include all of Europe, Russia, New Zealand and Turkey. (Argentine passport holders do need a visa to the USA, Canada, and Australia, however.)

But in order to get on the path to Argentine citizenship, you first need to establish legal residency there. As of April 2021, the Argentine Rentista Visa offers a relatively simple path towards establishing the first step towards citizenship, being legal residency.

The Rentista Visa Program at a glance

Rentista visas are common throughout Latin America, and we have covered the programs of Chile and Colombia in Sovereign Confidential, among others.

In essence, these programs are for ‘rentiers’—people with independent income from property, investments and such.

In Argentina, in order to qualify for the rentista visa, you need to demonstrate a minimum of $2,000 per month in passive income, which needs to be transferred to an Argentine bank account in your name.

If you want your spouse and children to become residents as dependents as well, the monthly income requirement remains the same—$2,000 or more.

The following type of income is suitable for the rentista visa:

The rentista visa is a temporary one-year visa. It can be extended in one-year increments.

After two years of holding temporary residency, you can apply for naturalization.

You can, and in fact should, initiate the residency process while in Argentina, not at a consulate abroad, as doing so will only complicate matters unnecessarily.

Chile is one of the most underrated and highly livable retirement destinations in the world. In fact, it’s a country that most of the Sovereign Man team have lived in, and we’ve even started a large commercial scale agriculture business there. (This operation is going from strength to strength.)

The cost of living in Chile is quite high, relative to other Latin American countries, however retirees from North America and Europe will enjoy significantly more purchasing power than at home.

Chile has had its share of political issues in the past few years, and its COVID-19 lockdowns have been exceptionally strict. But generally speaking, it offers one of the best living standards in Latin America, coupled with modern infrastructure and good public healthcare.

In addition, its rentista visa program offers a relatively straightforward path to Chilean residency.

The Chilean Rentista Visa

Most of our readers take this route to obtain Chilean residency. If you earn a periodic, stable income (from sources other than a salaried job), the rentista program should be an excellent option for you.

It is important to note that your income has to be passively earned – a pension or rental income from a property you own will work. While there is still no set amount of money required in order to be approved, our legal contact in Santiago recommends showing $1,500+ in income, per month, for the primary applicant, and an additional $500+ per month for each additional dependent.

Previously, the government also allowed you to also show a lump sum in your bank account — six figures or more — and qualify this way. But currently, only the passive income option works.

Important: Please note that you are no longer able to apply for the rentista visa from inside Chile; you now have to apply via your closest Chilean consulate in your home country.

The bottom line?

Chile is an excellent retirement option to consider going into 2022 and beyond. Especially if you’re looking at settling in a smaller town or in the countryside, you can enjoy a high quality of life at a relatively low cost, and experience little restrictions, if any, in the event of future pandemic lockdowns.

Looking to spend your golden years in a sundrenched beach location or scenic highland town? Situated in close proximity to the US, Costa Rica offers a relaxed lifestyle, good living standards and a substantially lower cost of living than the US.

Aside from the road infrastructure that can be patchy in places, the country has a lot to offer. From a carefree life, great food, to a true connection to nature.

So if you’re looking to stretch your retirement funding while enjoying the finer things in life, Costa Rica could be a great option for you.

However, Costa Rica is not a good choice for second residency if you only want to show up for a day a year in order to maintain your residency. If that’s what you are looking for, Panama residency may be a much better fit for you.

Therefore, only consider residency in Costa Rica if you decide that this is where you want to spend a significant amount of your time.

Having official residency can be highly beneficial

Having official residency can be highly beneficial — especially if you’re a US taxpayer, since it’ll be much easier to prove that you’re a bona fide resident of a foreign country and claim your Foreign Earned Income Exclusion.

This allows you to earn over $100,000 in foreign income (more if you include foreign housing deductions) and not pay any US taxes on it.

Let’s get into the Costa Rican visa options for expats below:

The Costa Rica Pensionado Visa

The pensionado or retirement residency visa is pretty self-explanatory. This type of visa has been around in Latin America for more than 40 years, and is typically used by people who are eligible for private or government pensions in their home countries.

This is a temporary residency visa targeted at financially self-sufficient retirees. In order to meet the program’s minimum income requirement, you’ll need to provide proof of income of US$1,000 per month (or equivalent) from a permanent pension source or a retirement fund.

(Combined pensions for one individual qualify. Government, private sector pension, or social security pensions all qualify.)

Though again, this pensionado visa won’t work as a “paper residency”; you have to spend 122+ days per year living in Costa Rica in order to keep your residency renewable.

You cannot work in Costa Rica on this visa.

Learn EVERYTHING you need to know about the BEST places to live, when you move to Puerto Rico…

Download our FREE guide, and dive into:

This 32-page report (with pictures) is brand new and absolutely free.

What is a "paper residency"?

A paper residency is a legal residency that you can maintain by spending minimal time in a country – usually just a few days per year. This kind of “back-pocket” residency permit forms an essential part of a robust Plan B for many people, as it creates optionality.

It gives you more options in terms of where you can live, should things go wrong in your home country. And it can be a powerful way of assuring your freedom to travel internationally during lockdowns and travel bans.

(Most countries in the world banned travel for tourism purposes during COVID-19, yet still allowed their citizens and residents to enter despite the travel bans…)

The Costa Rica Rentista Visa

This visa option is well suited to “rentiers”, e.g. applicants deriving stable income from the rental of movable or immovable assets. In order to qualify for this visa, you’ll have to provide proof of having a monthly income of US$2,500 per family for 2 years, OR US$60,000 deposited in a Costa Rican bank.

(This requirement must be met every 2 years — see below).

You also cannot work in Costa Rica on this visa.

For both the rentista and pensionado visas, the application process can take between eight and 14 months, with renewals required after two years, then after three years, and then at five-year intervals thereafter.

Ecuador is a highly popular retirement destination among Americans and Canadians, offering pensioners the ability to live exceptionally well on a shoestring. Boasting a diverse landscape covering everything from snow-capped volcanoes and pacific beaches to lush jungles and colonial cities, Ecuador truly has something for everyone.

With a monthly budget of around only $2,000, you can make the most of your retirement years without breaking the bank. The country boasts a growing middle class, rapidly improving infrastructure, a stable economy and a reasonable level of personal safety.

The country has, however, been known to have occasional bouts of political instability…

Property prices in Ecuador are exceptionally low compared to countries like the US, enabling many retirees to own both a primary home in the city and a beach or country home elsewhere in the country.

It therefore comes as no surprise that the country’s community of expat retirees is growing year by year.

To top it all off, the country makes it very simple and straightforward to obtain a residency visa permit there.

The Ecuador pensionado visa at a glance

If you want to stay in Ecuador for more than six months at a time, you’ll have to apply for a resident visa there. (Doing so is also the only type that lets you bring belongings into Ecuador duty-free.)

First, you’ll obtain a temporary residency, which lets you stay in Ecuador for two years. These visas can now be renewed indefinitely.

In order to be eligible, you’ll have to prove earning sufficient retirement pension from abroad to cover your expenses in Ecuador.

You’ll need to earn at least $800 per month as a single applicant, and an additional $100 per month for each additional dependent.

Permanent residence visas can be applied for at the 21-month mark from the temporary visa one. These visas are granted for unlimited periods.

A very welcome recent change is that bearers of temporary resident visas will no longer have length of stay abroad limitations, meaning that you can now travel freely outside of Ecuador for indefinite periods.

Please note: Permanent resident visa holders will not be able to be out of Ecuador for over 180 days per year during the first two years and for over two continuous years afterwards.

If sundrenched island living is your idea of a good time, then retiring in Greece could be just the option for you. Whether you choose to settle on Santorini, Corfu, Crete or Lefkada — all highly popular among expat retirees — you’ll get to enjoy amazing weather and acclaimed cuisine in one of the prettiest countries in Europe. (It’s also one of the safest countries in Europe.)

And given the country’s relatively affordable property and low cost of living, your retirement years can be truly carefree.

Similarly to Portugal, Italy and Spain (featured below), Greece seeks to attract financially self-sufficient non-EU nationals via its long-term (temporary) residency visa program. Their passive income residency program is commonly known as the Greek Financially Independent Person (FIP) Visa.

Applying on the basis of recurring income, the minimum requirement for a single applicant is €2,000+ (~$2,401+) per month. An additional €400+ (~$480+) per month is required for your spouse, while an additional €300+ ( ~$360+) per month is required per dependent minor child.

Social security income and pension are known to be acceptable; other forms of income may not be eligible.

For those seeking to apply on the basis of savings, the program requires a deposit of at least €48,000+ (~$57,637+, calculated as €2,000 x 24 months) into an account with a Greek national bank.

To include your spouse, you’ll need to deposit an additional 20% (€9,600+, or ~$11,527+), while the deposit required increases by 15% (€7,200+, or ~$8,645+) for each dependent minor child.

The FIP residency permit is initially issued with a validity of two years, after which it becomes renewable at two-year intervals – provided that this deposit is maintained.

It must be mentioned that the Greek banks don’t have a sterling track record in terms of protecting their depositors’ funds, so this is definitely a risk worth considering.

The FIP residency program requires you to stay in Greece for a minimum of 183 days per year, making it unsuitable as a “paper residency”.

Also, as is the case with Spain’s Non-Lucrative Visa, you’re not allowed to get a local job in Greece on the FIP Visa, though you can keep working on your remote job or business.

If you’re not 100% sold on Greece, the Portuguese D7 Visa could be an attractive – and far more affordable – alternative…

Who couldn’t see themselves settling in Tuscany, shopping in Milan, and spending summers on the shores of Lake Como? While northern Italy can be quite expensive in terms of its cost of living, the southern parts of the country offer low-cost, high-quality living.

The Italian Elective Residence Visa Program competes with the likes of the Portuguese D7 Visa, the Spanish Non-Lucrative Visa and Greece’s Financially Independent Person (FIP) Visa (all discussed in more detail in the respective sections of this article).

Similar to the above EU pensioner visa programs, the Elective Residency program requires non-EU applicants to have sufficient financial means to support and accommodate themselves in Italy without the need to get a job locally.

The program requires significant, stable and recurring income from passive sources such as pension, dividends, fixed-rate interest earnings or the rental of movable or immovable assets.

And while the program is targeted at affluent retirees, anyone capable of meeting the program’s requirements can apply, regardless of their age.

The minimum passive income requirements for the program are as follows:

Important: As with the other EU retirement / passive income visas, the exact income requirement can vary from one Italian consulate to the next. Be sure to confirm the exact program requirements with your local Italian embassy, and treat the above amounts as the absolute minimums.

The more income and savings you can prove, the better.

In addition to the above passive requirements, you’ll also have to demonstrate that you have accommodation in Italy, pre-paid for 12 months, along with comprehensive medical insurance cover.

In addition to having significantly higher passive income requirements than its Iberian competitors (Spain and Portugal), it is also harder to apply for without the assistance of a professional service provider.

Furthermore, the program’s requirements are poorly documented in English online, and the Italian bureaucracy can be challenging to navigate – especially if you don’t speak Italian.

It must also be noted that the Elective Residence program is not suitable as a “paper residency” – in order to keep your residency status renewable, you won’t be allowed to leave Italy for any period longer than six uninterrupted months.

However, if settling or retiring in Italy is your objective, the Elective Residence program can help you get there without the need to make a significant property investment.

Note: While Portugal, Greece and Spain all have property-purchase based Golden Visas, Italy does not. Instead, Italy offers a €250,000 (~$300,278) Innovative Startup Visa. The program is, however, convoluted and reported to have a very high rejection rate.

Mexico is one of the most underrated second home destinations in the world. At Sovereign Man, we’ve done the boots-on-the-ground research, and we’re quite bullish about the country — and especially as a retirement destination.

Given its natural beauty, world-class beaches, sumptuous cuisine and proximity to the US, it truly is a stand-out location for Americans seeking to up their quality of life and reduce their cost of living.

Out of all the countries our team has been to in these challenging times, Mexico has been one of the stand-out destinations in terms of reasonable COVID-19 regulations and its overall sense of pre-pandemic normalcy.

At the beginning of 2021, we even hosted a highly successful and well attended Total Access event in Cancun.

In fact, one of our own team members and his family escaped the stifling lockdowns in Chile to go ride out the pandemic in Playa del Carmen, which in comparison with Santiago was massively relaxed and largely mandate-free.

Apart from Mexico being situated close to many American cities, getting in and out of the country also proved to be a breeze during the pandemic. Even during the apex of 2020’s lockdowns, there were still plenty of non-stop flights between Mexico and cities like Houston, Paris, Miami, New York, Madrid, Los Angeles and Amsterdam.

Mexico was super cheap even before COVID-19. But since the pandemic struck, the cost of living has become even more affordable. Our team member reports spending only $800 per month on rent for an upmarket, fully furnished two-bedroom condo in Playa del Carmen, with a delicious brunch in the trendy town of Tulum costing as little as $7.50.

So if you’re a foodie, then you’re going to love living in Mexico.

Many people hold the view that Mexico is stereotypically dangerous. And this can be the case in certain parts of Mexico. Yet, in many Mexican towns and cities, safety is simply not an issue.

For example, the state of Yucatan — home to the colonial city Merida — has the same violent crime rate per capita as peaceful Wyoming. And Quintana Roo, where Playa del Carmen and Cancun are located, is only slightly more “dangerous”…

While America, Canada, the UK and most of Europe were subjected to insanely petty lockdown regulations, in Mexico, it was pretty much business as usual.

Americans, Canadians, Britons and EU nationals can enter Mexico without a visa and stay for up to 180 days, no questions asked. And as of April 15, there still aren’t any PCR testing requirements upon entry.

Want to stay longer than six months at a time?

No problem. Temporary residency in Mexico is easy to acquire for anyone who can prove they have sufficient savings or income. You’ll need at least $2,000 per month after taxes, plus around $700 for each dependent. Alternatively, you can apply on the basis of savings — $40,000 or so per person should be sufficient.

After holding temporary residency for four years, you can upgrade to permanent residency. That is a great asset that gives you another option to live and work (or escape) outside of your home country. And you can complete 95% of the application process without leaving your home.

Retirees also have a shortcut to permanent residency in Mexico. As long as you can prove you are officially retired and have a pension or Social Security income of at least $3,500 per month, you can qualify for permanent residency immediately.

Alternatively, you can replace it with around $100,000 in your bank account, or liquid investments. (And some consulates do not even require you to be retired at all.)

After five years of legal residency, you can apply for naturalization, which means becoming a Mexican citizen, and obtaining a Mexican passport.

Panama is still an excellent option for Americans, both as an escape hatch and retirement destination – and not just based on its close proximity to the US.

Panama has come a long way in the past couple of decades, with a middle class that in 2021 is around 2-3x the size of those found in its regional neighbors, Honduras and Nicaragua.

The country offers decent infrastructure and living standards, a comparatively low cost of living, and plenty of quaint towns and beautiful natural attractions to explore during your retirement years.

What makes the country especially attractive is its easy residency requirements. By our

team’s last count, there were at least 50 different ways of obtaining residency in Panama.

Three of the most prominent paths to Panamanian residency have included:

Path 1: The Friendly Nations Visa Program

This was by far the easiest way of establishing legal residency in Panama, and it’s open to applicants from around 50 “Friendly Nation” countries, including the US, South Africa, Canada, Australia, Germany, Singapore and the UK.

Launched in 2012, the Friendly Nations program enables applicants from Friendly Nation countries to apply for Panamanian residency on the basis of company formation. Setting up a Panamanian corporation is fast, affordable and easy.

Additionally, you only needed to deposit around $5,000 to $10,000 in a local bank account in order to meet the program’s financial requirement. A deposit of $10,000 should be enough for your whole family to qualify.

Sadly however, this program became a lot more expensive and restrictive as of August 2021.

Once you received your visa approval, you can either withdraw the money, and close the company (to save on ongoing costs), or keep both and use the funds for living expenses while in Panama.

Friendly Nations retirees enjoy a host of benefits in Panama, including discounts on public transport, airfares, dining out in restaurants, fast food, medicines, certain medical services, services such as plumbers and electricians as well as water and electricity bills.

Best of all, Panama is an excellent option as a “paper residency”. You only need to visit Panama once every two years to maintain your residency status, making it an excellent Plan B destination.

Path 2: The Panama Retirement Visa (Pensionado Visa Program)

Panama was one of the first countries in the world to launch a pensioner specific visa program. In order to qualify, you’ll need to show at least $1,000 per month in pension from a government or private pension scheme.

Importantly, you’ll have to prove that this income will be earned for the rest of your life; the Panamanian government wants to be sure that you can cover your living expenses while retiring in the country.

The above amount is sufficient to cover both individuals and married couples. However, if you buy a property in Panama valued at $100,000 or more, the minimum income requirement goes down to only $750.

For every dependent minor child (or children up to 25, provided that they’re single and still studying), the income requirement goes up by $250 per month.

Path 3: The Panama Residency By Investment Program

During 2020, Panama launched a Residency By Investment Program aimed specifically at countries not featured on the Friendly Nations list. Under this program, you can choose from one of the following four investment options:

You can find out more about obtaining Panamanian Residency By Investment here.

Sovereign Man has long held Panama to be an excellent Plan B destination. This is not to suggest that Panama is all rainbows and buttercups; on the contrary – the country has its own unique challenges, as does practically every other country listed here.

But if you’re looking for a paper residency as a back-up plan, Panama is well worth considering.

Take Back Control Of Your Retirement Savings Today.

Don’t let the stock market hold your retirement savings hostage – discover two powerful tools to help you take back control and invest in REAL assets in 2022!

In this report…

Portugal is an excellent travel and retirement destination, scoring high on climate, scenery, cuisine, healthcare, and cost of living, in particular.

What makes it even more attractive is that it’s got one of the best retirement visa programs in the world — and it’s relatively unknown.

Just about everyone’s heard about the Portuguese Golden Visa Program – the one costing at least €280,000 (~$336,310) excluding fees. But if you’re looking to actually move to Portugal, there is a far better alternative – and it’s vastly more affordable.

The Portuguese D7 Visa offers foreigners who can support themselves financially the ability to settle in Portugal without having to invest in property. (Although you are required to have an address there.)

The only catch is that it’s not well suited as a back-up plan, as you’re expected to spend around six months per year living there.

Best of all, this residency program offers you the ability to become a permanent resident or apply for citizenship and a Portuguese passport after only five years, making it one of the most attractive programs of its kind in the EU, and one of Sovereign Man’s favorite residency visa options.

Who’s it for? (EVERYONE)

While the D7 program is well suited for foreign retirees wanting to spend their golden years – or a large chunk thereof – in Portugal, the program is open to ANYONE who can meet the program requirements.

What are the key program requirements?

1. Savings, passive income, or a combination of the two:

To obtain residency under the D7 program, you will need to prove that you have sufficient savings or recurring income to sustain yourself for at least 24 months in Portugal.

(Two years is how long your initial and subsequent residency permits are valid for. The official financial requirements are quite low, and tied to the Portuguese minimum wage (which, in 2021, is €665 (~$798) per month).

So whether you are a remote worker, a digital nomad or just semi-retired, you can apply, provided that you have sufficient passively sourced income, adequate savings, or a combination of the two. (More on this below…)

Option A: Applying on the basis of passive or recurring income:

Long-term, stable income such as rental income, fixed-rate interest, royalties, pension or even dividends (provided that you’re not operationally involved in the business) and salaried income can also be used as the basis for your application.

In line with the required amounts above, you’ll then need to be able to prove that you have at least the following amounts of passive recurring income with which to house and support yourself and any dependent applicants:

Again, you can also apply on the basis of a combination of savings AND passive income.

Option B: Applying on the basis of savings:

So, a family of four would need to prove they have €33,516 (~$40,500) of savings to qualify.

But that’s the bare minimum. It’s better to show at least a few thousands more.

Your local Portuguese consulate — where you’ll submit your residency application — can advise you about what minimum sum they’d realistically like to see.

2. Proof of accommodation in Portugal:

In order to apply, you must have an address in Portugal. This requirement can typically be met by signing a property lease agreement, renting an Airbnb property, or by having a friend living in Portugal issue a letter confirming that they are willing to accommodate you.

3. Minimum stay requirements:

Unlike with the Portuguese Golden Visa, you will need to spend four to six months per year in-country, depending on how many times per year you will be visiting.

In practice, this means that the D7 is NOT well suited as a back-up plan — you actually need to spend around six months or more per year in Portugal. But if that is your intention, it’s an excellent option.

Who doesn’t want more sangria, tapas and sunshine in their diet? Spain is one of the most popular expat retirement destinations in the world — and with good reason.

Offering world-class beaches, magnificent architecture, a vibrant culture and one of the lowest costs of living in Europe, it’s no surprise that more Americans and Canadians are choosing Spain for retirement.

However, if you’re not quite sold on shelling out over €500,000 (~$600,450) for a property under Spain’s Golden Visa program, there is an excellent — and vastly more affordable — alternative.

The Spanish Non-Lucrative Visa Program offers an easy path to residency and, potentially, eventual Spanish citizenship – and it’s the perfect residency option for pensioners.

An overview of the Non-Lucrative Visa (NLV) Program

While the Non-Lucrative Visa is widely known as the “Spanish retirement visa”, you don’t need to be of retirement age to apply. Yet the fact that you can’t work in Spain on a Non-Lucrative Visa does make the program more suitable for retired folks…

Key program advantages

Simply complete the form on our program page if you’d like to speak with a Spanish immigration professional.

Additional things you should know

Key income requirements

Similar to with the Portugal D7 Visa, you can apply on the basis of:

Applying on the basis of recurring income:

The minimum financial requirement for the program is calculated based on the IPREM, a financial index focused on the country’s cost of living. As of 2021, the IPREM’s monthly value is €564.9, and the minimum monthly requirement for a single applicant is set at IPREM x 4 (€2,259.60, or ~$2,712).

For every additional dependent, this amount goes up by another IPREM value of €564.90 (~$678).

This means that a family of four applying for a NLV will need to show a monthly income of €3,958+ (~$4,753+).

Applying on the basis of savings:

As a main applicant, you will need to have at least €27,115+ (~$32,561+, calculated as €2,259.60 x 12) in your bank or brokerage account, plus an additional €6,778+ (or ~$8,139+, calculated as €564.90 x 12) for each dependent you bring with you.

A family of four should qualify with around €47,500 ( ~$57,040) in savings.

You can learn more about the exact income requirements for the Non-Lucrative Visa here.

Important: Be sure to confirm the exact requirements from your closest Spanish consulate or embassy and prepare your application based on their confirmed requirements at the time.

Uruguay is not the right place if you want a “paper residency.”

To obtain a permanent residency in Uruguay, you will need to live there. It can take anywhere from 8 to 12 months.

If you want to spend significant time in Uruguay – and it’s a great place to live – then obtaining a legal residency isn’t difficult. You don’t need to invest in the country or buy expensive property. You just need to prove that you can support yourself.

Showing $1,500 per month in income is usually enough. For a family of four, around $5,000 per month should be sufficient.

(That’s comparable with the financial requirements in Chile and Argentina. For a family of four, Chile wants to see around $3,000 in monthly income. And Argentina will be satisfied with just $2,000 a month.)

You can combine any kind of income, including your rental income, pension, social security payments, dividends, and even your location-independent income coming from your online business or freelance activities.

Once you are a permanent resident in Uruguay, there is no longer a requirement to spend time in the country. You will lose your resident status only if you leave Uruguay and stay abroad for more than three years.

After spending the required number of years in a country, you will become eligible to file for naturalization in Uruguay. Uruguay is unique in its requirements, as it differentiates between married and single applicants.

If you are single, you can apply for naturalization after five years as a resident, and if you are married three years is sufficient. This residency period (of three or five years) starts counting from the moment you first arrive in Uruguay to file for residency.

To apply for a Uruguayan passport, you will need to spend at least six months each year in the country during your residency period.

Bonus: When you become a citizen of Uruguay, you also become a citizen of Mercosur. Established in the early 1990s, Mercosur is a free trading union of countries, which includes Argentina, Brazil, Paraguay and Uruguay.

Citizens of this union can travel, live, work, study or retire across the other member countries with ease. Associate members Chile, Peru, Ecuador, Colombia, Guyana, and Suriname, and freedom of movement applies to them also.

The world is full of incredible opportunities, and at Sovereign Man, it is our mission to help you uncover them — even into your golden years. Our Sovereign Confidential members benefit from Monthly Alerts, Intelligence Reports and Black Papers covering topics ranging from second residency and citizenship to retirement planning, legal tax reduction and offshore strategies.

Join Sovereign Confidential today to start benefiting, or discover some of our top free content resources below…

Learn EVERYTHING you need to know about the BEST places to live, when you move to Puerto Rico…

Download our FREE guide, and dive into:

This 32-page report (with pictures) is brand new and absolutely free.