Gold Standard:

Are there Currencies Backed by Gold?

-

AUTHOR

James Hickman -

PUBLISHED

July 9, 2020

If you’re here, you likely know your dollar, euro, or pound sterling is little more than paper (or digital) money…

And you know, instinctively, that this is not a good situation for your hard-earned cash.

Why? Because these currencies are not backed by a gold standard (or anything else of real value), except for the trust people put into the stability of those currencies.

That might matter little when there is plenty of confidence in that paper, and the government backing it.

But just the events of 2020 alone should destroy any remaining confidence in the US dollar, US government, and US Federal Reserve.

That is because $3 trillion was conjured out of thin air in just the first three months after COVID-19 hit the US.

And at the same time, the economy shrank. With more cash, and fewer goods and services in the economy, it doesn’t take a genius to think, maybe the value of the dollar isn’t so stable.

National debt is now more than 25% larger than the entire US economy.

Where is the safe haven so that your wealth doesn’t simply disappear?

Naturally, you want a backup plan.

There’s good news and bad news.

You yourself, without any government intervention, can protect your own hard-earned savings.

In this piece, we’ll show you how to do just that.

We’ll take you through a few simple, iron-clad, time-tested solutions that help ensure that your money is more than just a piece of paper.

Learn EVERYTHING you need to know about

buying, owning, storing and investing in gold & silver…

Download our FREE precious metals report and learn…

This 50-page report is brand new and absolutely free.

More than 5,000 years ago on a hilltop located in modern-day Georgia (the country, not the state), a group of people from the prehistoric Kura-Araxes civilization gathered their primitive tools and began to dig.

It took years. But they eventually burrowed 20 meters deep into the earth and constructed a network of elaborate tunnels.

Thousands of years later, archaeologists and geologists figured out why: the Kura-Araxes were digging for gold.

And that site, known as Sakdrisi-Kachagiani, is the oldest gold mine in the world. It predates Ancient Egypt and even Mesopotamia.

And it shows that, even in prehistoric times, our early ancestors valued gold.

Soon after they started using gold as a medium of exchange…

Ancient cultures realized that they needed a more efficient way to exchange goods and services than barter and so they started using gold and silver for trade.

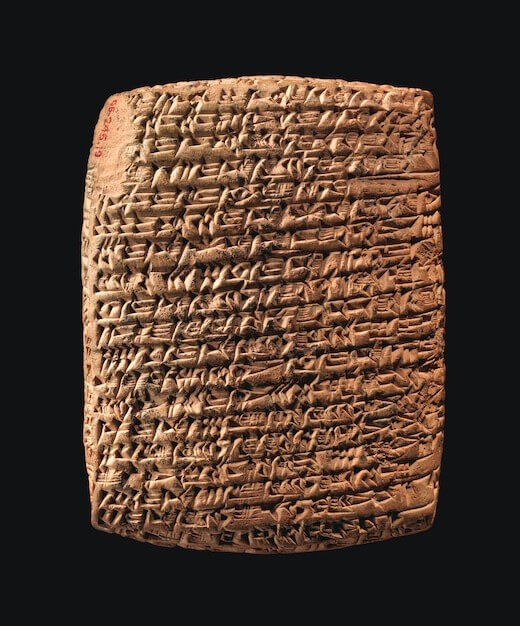

One of the oldest examples is a cuneiform tablet on display at the Met in New York City that documents the terms of a loan that originated in Kanesh, a trading city in the Assyrian Empire, some time in the 19th century BC.

According to the tablet, an Assyrian merchant named Ashur-idi loaned 3kg of silver to two traders, with 1/3 of the amount to be repaid in one year’s time.

This was fairly common back then: gold and silver were both used as a medium of exchange in ancient times.

But it was a cumbersome system that required elaborate scales to weigh gold and silver when exchanging goods.

So, the next evolution of money was the introduction of gold and silver coins around 2,500 years ago...

Coins helped bring standards and stability to trade. Coins had the advantage of being easily recognizable and divisible. They also had the benefit of their value and purity essentially being endorsed by whoever minted them– usually a government or ruler.

Some of the first gold and silver coins called the Croeseid began circulating in Lydia, located in modern day Turkey, around 550 BC.

Egypt, Greece, and Rome also started mining and minting gold and silver coins around the same time, which helped ancient economies boom.

Darius the Great, the Persian ‘King of Kings’ ruling over the vast Achaemenid Empire around the same time, established an official value ratio between gold and silver.

Darius decreed that one gold “daric” was worth 13.5 silver coins– one of the first examples in history of a fixed, bimetallic standard.

The ratio between gold and silver is near a 100-Year High

(which could mean that silver could increase by 5 TIMES…)

The value of gold and silver has been linked for thousands of years. In modern times, one ounce of gold is typically worth around 50 ounces of silver.

But in March 2020 that gold/silver ratio hit an all time high of 1:120. That means the price of silver could skyrocket as the ratio corrects (as it always has before).

Learn more inside our free Ultimate Gold & Silver Guide…

And then finally paper money was introduced…

Promissory notes became popular in China during the 600s.

Carrying around large amounts of bulky amounts of coins became a hassle. So merchants would leave their coin with a trusted third party. In return for the deposit of coins, they would receive a receipt. The coin could be redeemed by anyone with the receipt.

Then around the year 1000 the Chinese government went into the business of issuing similar notes. These notes could be turned into the government in exchange for real coins, making them a precious metal backed paper currency.

Around 1150, the Knight Templar arranged a similar system for pilgrims traveling to the holy land, so they would not have to cart heavy gold and silver coins over thousands of miles.

Pilgrims could deposit their valuables local Templar depositories in Europe, and receive a note detailing the value of the deposit. Once they reached the Holy Land in the Middle East, the pilgrims could redeem the receipt from the treasury.

But it’s important to understand that in each of these scenarios the paper notes always represented a claim to a physical asset like gold and silver.

The paper itself was only worth the promise of actually receiving the tangible precious metals.

And…

The value of gold a thousand years ago is actually eerily similar to the value of gold today.

In 929, roughly 1100 years ago, Abd-ar Rahman III of the Umayyad Dynasty was proclaimed ruler of Cordoba– the Islamic kingdom that comprised most of Spain at the time.

Historians Denis Cardonne and Edward Gibbon calculate his annual tax revenue at approximately 12 million gold dinars… which was a LOT.

The dinar contained 4.25 grams of gold, so 12 million of them would be worth about $2 billion today.

With Cordoba’s population estimated at around 500,000 people back in the early 10th century, that works out to be the modern day equivalent of $4,000 in tax per person.

Records from the same period in Islamic history show that the homes of wealthy individuals were worth between 10,000 and 30,000 dinars, and much higher among the ultra-rich.

That’s roughly $1.7 million to $5 million in today’s money– very much in line with what wealthy individuals pay for homes today.

And gold continued to play a critical role even in more modern times...

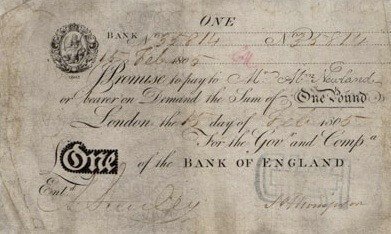

From 1700-1850 the United Kingdom steadily established a standard measure for gold as a unit of money.

Around 1850, paper notes, redeemable for gold, were created by the UK. Thus the start of the modern gold backed currency.

You could literally go to the bank and trade your paper note for gold.

That is what it means for paper currency to be on the gold standard.

From 1793 onward gold helped cement the economic growth of the United States.

Although a number of state and private bank paper currencies came and went during the first hundred years the United States existed, gold and silver coins were always used in tandem, creating stability.

In 1861 US Treasury Secretary Salmon Chase created the first official US federal paper currency since the Revolution. But it was not officially backed by and redeemable for gold until the Gold Standard Act of 1900.

It was at this point that the official worth of the US dollar was set in gold: $20.76 per one troy ounce of gold.

In 1913, the US government further formalized gold and currency standards when it created the US Federal Reserve.

Then World War I broke out.

In order to print enough money to pay for their military operations, many European countries left the gold standard. That led to hyperinflation which is when people lose faith in a currency, and the value becomes almost worthless.

In Germany, this is part of what led to the rise of Adolf Hitler and thus WWII.

Between the two wars, Europe largely went back to the gold standard.

In the United States, once the Great Depression hit in the 1930s, Americans held onto their gold to protect a portion of their wealth.

President Franklin Delano Roosevelt didn’t like that. The Federal Reserve had been raising interest rates to make the dollar more valuable, but this depleted US gold reserves.

And so, …

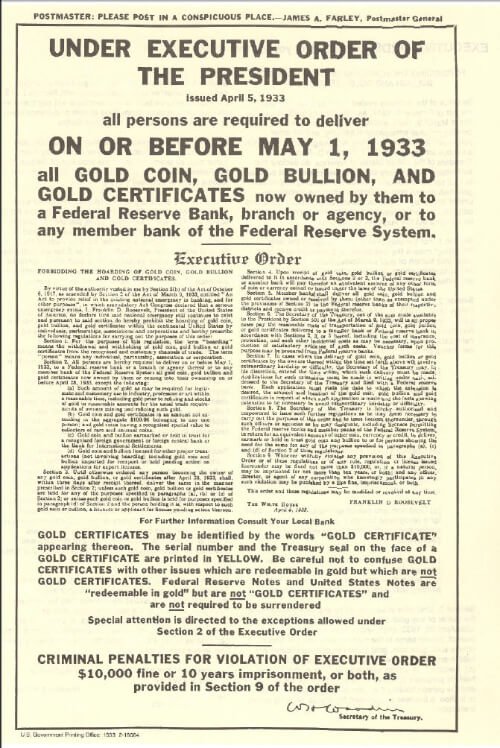

On April 5, 1933 Roosevelt outlawed private ownership of gold and essentially stole nearly half of the wealth of gold owners.

Roosevelt said people were “hoarding” gold. To justify the seizure, he used wartime authorities under the “Trading with the Enemy Act of 1917”. The law was never repealed after World War One, so Roosevelt used it to declare a national banking emergency.

Roosevelt’s order demanded that all Americans must surrender their gold to a Federal Reserve Bank by May 1, 1933, less than a month after he signed the executive order.

Gold was a popular form of savings at the time; US dollars were convertible to gold, and many Americans, from wealthy business owners to rural farmers, owned gold as a form of savings.

So Roosevelt’s order affected a LOT of people.

Anyone who failed to comply faced up to ten years in prison, and a $10,000 fine– which was a huge sum at the time, equivalent to several times a typical annual salary.

For people who complied with the order, the government paid them $20.67 for every ounce of gold that was turned in.

Then Roosevelt raised the price of gold to $35, essentially stealing nearly half of the wealth of those former gold owners.

About Gold Confiscation…

If you own gold, you should strongly consider storing a portion of it offshore. It’s completely legal and if done correctly doesn’t even need to be reported. This can protect you from confiscation, frivolous litigation and social unrest.

One ultra-safe storage facility even allows you to make and receive peer-to-peer loans backed by precious metals.

This is a great way to get liquidity without selling if you own gold or generate a safe, strong investment return on your cash.

You can learn more about this strategy inside our Ultimate Gold and Silver Guide.

How the US Dollar became the world’s dominant reserve currency

The dollar was still tethered to, and technically backed by, gold. But Americans could no longer literally trade their dollars for gold. So that crucial piece of what made the dollar valuable to the citizens was gone.

But other countries’ governments could still trade their US dollars for gold. And that made the US dollar very popular with foreign nations around the world.

Since the dollar was pegged to gold, and the US had the most gold, other countries started judging the worth of their currencies in terms of the dollar.

In 1944 with the Bretton Woods agreement, the US dollar became the world’s dominant reserve currency.

That meant, for instance, that whenever a Brazilian merchant pays a Korean supplier, that deal is negotiated and settled in US dollars.

Oil, coffee, steel, aircraft, and countless commodities and products across the planet change hands in US dollars, so nearly every major commercial bank, central bank, multi-national corporation, and sovereign government must hold and be able to transact in US dollars.

This system provides a huge incentive for the rest of the world to hold trillions of dollars worth of US assets– typically deposits in the US banking system, or US government bonds.

But it also represents an immense power over other nations.

The world would come to see this arrangement allow the US to go into massive debt, wage war, sanction nations, destroy foreign banks, and bully practically every institution in the world into complying with US interests– however bad that may be for the other guy.

How the last country on earth abolished the Gold Standard...

In the aftermath of WWII, the US prospered as Europe and the rest of the world languished, mopping up their losses. The gold standard held, and the dollar was doing quite well.

By 1960, the US had more than $19 billion in gold reserves, which covered (via the gold standard) all the dollars around the world.

But then things started to get sketchy. As the US economy grew — the Baby Boomers are the richest generation in the history of the world — Americans bought more and more global imports.

That meant other countries held more and more dollars (in exchange for those goods). An imbalance ensued, and other governments started to worry that Uncle Sam couldn’t back up all those dollars with gold.

By 1970, those fears proved true. The number of dollars held around the world tripled what the US held in gold at Fort Knox.

Worse, the US economy was lagging to the point of being stagnant — hence the term “stagflation”, which described the enormous inflation the country was undergoing.

On August 15, 1971 President Richard Nixon signed the order breaking the Fed’s authority to redeem dollars with gold.

In one moment - poof — no more gold standard.

So, for more than 99% of the history of human civilization, money actually meant something… right up until 1971 when Richard Nixon ended any remaining link between the dollar and gold.

The problem for big spending US politicians was that the gold standard forced the US to live within its means.

Before 1971, if too much money left the US and didn’t come back because of a trade deficit, the US couldn’t simply print more dollars. And if another nation decided to trade their dollars for gold, the US had to deliver. That meant losing gold with real value.

Since other countries already held massive amounts of US dollars, this incentivized them to continue using the dollar as a reserve currency. By then, there was no other large country on a gold standard, so there was no real reason to replace the US dollar anyway.

Without the gold standard the US could print and spend all the money it wanted. And the government was happy to accept the main consequence: inflation.

That is when the dollar loses purchasing power because the supply of dollars grows, while the supply of goods and services stays the same.

Governments benefit from this because they are in debt. They can pay back their past obligations with less valuable dollars in the future.

Wealthy people benefit from inflation, because it drives up the prices of real assets like real estate, stocks, and precious metals.

Wealthy people spend only a tiny fraction of their income on cost of living. Inflating prices of food, fuel and other common expenses has almost no effect on their spending power.

Thus, they can invest a large portion of their income into real assets and ride the inflation all the way up.

Thus wealthy people get wealthier, and poor people get poorer.

That’s the real root of the wealth gap. Abolishing the gold standard is the culprit of a rising wealth gap, and that gap will NOT be fixed by higher taxes or socialism.

Savers on the other hand, are punished. The value of the new dollars comes right out of the value of existing dollars.

When you control the money, you control everything…

Having the dollar as the world reserve currency has allowed the US to rack up record amounts of debt and wage indiscriminate wars in foreign lands.

The US has seriously abused this power by creating absurd amounts of regulations and expecting foreign banks to comply.

They’ve levied billions of dollars worth of fines against foreign banks who haven’t complied and threatened to banish any foreign banks from the US financial system who don’t pay their steep fines.

They’ve slammed foreign banks with record fines simply for doing business with nations that the US doesn’t like.

And they’ve demonstrated absolutely no willingness or ability to improve.

Financial markets, consumer prices, risk perceptions, investment habits, savings rates, hiring decisions, pay raises, sovereign debt, housing starts, and more are all controlled by the US dominated monetary system.

And many of these decisions are controlled by the Federal Reserve Board.

Out of 330 million people, a group of 10 individuals– all unelected bureaucrats and mostly academics with no real-world business experience– makes crucial decisions about how many dollars to print.

This irrational, arrogant system presupposes by design that a few central bankers are smarter than everyone else; that markets are incapable of determining appropriate risk and value; that he is more effective at allocating our time, capital, and labor than we are.

Future historians will be dumbfounded when they see how long people allowed worthless, unbacked fiat paper to pass as money.

In fact, it’s nothing less than extraordinary (in a negative way) that most people today happily accept a digital abstraction of paper currency as ‘valuable’.

But these days…

The dollar is in serious danger of plummeting in value or even being replaced as the world’s reserve currency.

Over the ensuing decades, the dollar has held a finger-grip as the world’s reserve currency.

And that means the US has been able to exert tremendous control over the global financial system.

Countries and businesses worldwide have to have access to the US dollar in order to settle payments in international trade. US sanctions, or a frozen bank account could spell disaster.

And even the banking systems which the US does not directly control can be– and are– bullied into doing the bidding of the US government.

If a country does not comply with US banking rules, for instance, and report certain transactions to the US government, the US could shut them off from global trade.

But that could soon change.

The US is now over $26 trillion in debt, and seems to be adding a trillion here and a trillion there, month to month. In March-May of 2020 alone, the government spent $3.8 trillion bailing out the economy due to coronavirus and the lockdowns.

The Federal Reserve simply prints the money– or, really, adds some digits on a computer screen.

Right now, apart from gold, the US dollar is the safest bet for central banks trying to hold some value. But all there is backing the US dollar at this point is confidence in its value. If that confidence falls, then there would be no reason to use the US dollar as a reserve currency.

And that seems to be the goal of countries like China and Russia. They are itching to move away from the US dollar as the world reserve currency. The two countries agreed in late 2019 to trade amongst themselves using the ruble and the yuan, and cutting out the US dollar.

If all your money is tied up with the US dollar, you are at risk of feeling the full brunt of a currency world war. You are at the mercy of every decision made by central bankers, at home and abroad.

That’s not something you want to rely on when it comes to preserving your wealth.

Fortunately, there’s a simple solution…

How did you like this article?

Click one of the stars to add your vote...

Other readers gave this article an average rating of 5 stars.

If you live, work, bank, invest, own a business, and hold your assets all in just one country, you are putting all of your eggs in one basket.

You’re making a high-stakes bet that everything is going to be OK in that one country — and in that one currency — forever.

Colored by a recency bias, that may well have seemed like a decent bet… up until March 2020.

Then came the global pandemic. That was bad enough for the economy, and authoritarian lockdowns only made it worse. And that of course led to the massive bailouts, dumping insane amounts of cash into the economy, while actual economic activity shrank.

Then came yet another unjustified murder at the hands of police, which spiralled into mass protests, and nationwide civil unrest.

Then there is the ever present threat of a trade war, cold war, or god forbid hot war with China.

And whatever happens in the November election, it could make the most recent riots look like a child’s play.

Look, we’ve been warning for years about these risks to the dollar, the economy, international relations, and so on. But now finally you can just look out your window and see it. You don’t just need a backup plan anymore. You need the tools to take your power back.

That could involve many different tactics like acquiring a second citizenship, foreign bank accounts, a homestead, and of course, what we are talking about here, gold.

That is what gold ultimately is: a rock solid insurance plan for your money when you look around, and don’t see any other safe haven in the world.

Creating your own personal gold standard gives you power back over your own money, finances, and wealth.

Clearly we are not in the best position relying on government currencies controlled by central banks. The good news is that there is an easy and effective way to personally protect yourself and your wealth.

Gold is the ultimate insurance plan.

Insurance is for the “I don’t knows.” And right now there are a lot of “I don’t knows” related to money, the economy, a global pandemic, and even riots and protests worldwide.

Gold protects us against inflation and money manipulation. It keeps our money out of the hands of the bankers who invest it in risky financial schemes that they don’t even understand.

Your home insurance might cover fire, earthquakes, or a tree falling on it. You don’t have to know exactly what will happen to benefit from the insurance.

Gold too protects you in multiple scenarios.

To prepare for the worst case scenario you will want at least some of your precious metals at home, so you could use them as money if things really deteriorate rapidly.

That means a total loss in faith of the US dollar, causing hyperinflation. Or it could mean an all out war, in which the financial and trade systems shut down.

There are plenty of scenarios where you want to be close to your precious metals, because you will need to actually use them as money, to buy food, for instance.

I’m not saying that the dollar is on the brink of a collapse today, but if COVID-19 has taught us anything is that ANYTHING is possible, even things you could never imagine.

That’s because completely unimaginable things have ALREADY happened. Just look at what happened in March 2020, when the oil price collapsed to MINUS $40. That’s not something anyone could have imagined and yet it happened.

In times like this, when literally NOBODY knows what’s going on it makes sense to prepare for the worst.

Especially when you can take advantage of strategies that make sense no matter what happens next– even if nothing happens.

You’ll never be worse off having a portion of your wealth protected in gold for example.

The most important reason for owning gold is that…

Gold is one of the VERY few asset classes that has ZERO counterparty risk

Most instruments in our financial system depend on another party. When you deposit cash at the bank, it stops being your money. It becomes the bank’s money.

You are just an unsecured lender, who the bank owes money to. But if the bank is reckless with it’s finances and goes under (as many banks have in 2008), then it simply won’t be able to honor your deposit.

This is what we mean by counterparty risk.

But when you own gold – real, physical gold – and not some financial instrument that follows the gold price, then you have no other counterparty to rely on.

Especially when you are storing it at home, in your own safe.

That means you don’t have to rely on a storage facility, a bank, or other intermediary to access your gold. You have it when you need it.

But it does mean you will want a strong home safe. How to determine if a safe is robust enough is something we also cover in our free Ultimate Gold and Silver Guide.

Then you should decide what type of gold to buy. Coins generally make more sense than bars for home storage, since they come in smaller denominations.

That makes it easier to buy or sell (or even spend) smaller amounts at one time.

Almost every country offers their own mintage of gold bullion coins.

You could buy a gold coin from Slovenia, but when you try to sell it, you may have trouble finding a buyer or may have to accept a lower price.

On the other hand, a Canadian Maple Leaf is the world’s most popular and recognized gold coin. You’ll likely easily find a buyer no matter where in the world you are– including Slovenia.

It makes sense to take a look at silver as well.

Silver is cheaper to get into, can be traded in much smaller denominations to gold, and may even have more potential upside at this point.

That is because historically, one ounce of gold was equal to about 10-15 ounces of silver.

In modern times, that ratio has stayed closer to 50:1 meaning one ounce of gold has the same value as 50 ounces of silver.

But during the first half of 2020, the price ratio has hovered around 100 ounces of silver to 1 ounce of gold. It even hit an all-time historical high of 120:1 in March 2020.

And in the past, the ratio has always been corrected.

That means either the price of silver could increase to make up the difference, or the price of gold could decrease.

But for all these reasons we have discussed it is pretty unlikely that gold will drop in value long term.

And that means silver is currently more undervalued than gold, and could give you more real value for your dollar.

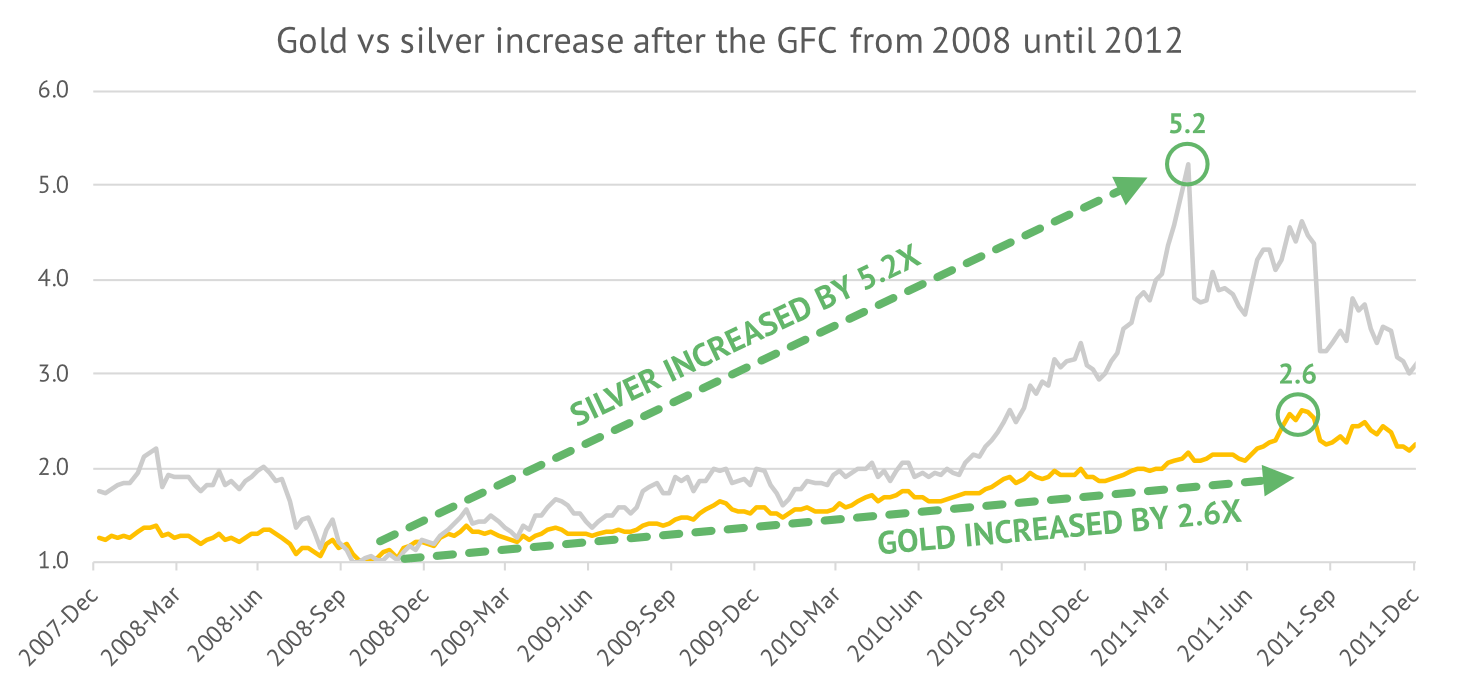

After the 2008 financial crisis, gold had an incredible run when it went from $716 to $1873.70. That’s a return of over 2.6x.

During the same time, silver went from $9.29 to $48.58. That’s an increase of over 5.2x– twice as much as gold’s increase.

Our free Ultimate Gold and Silver Guide goes even deeper into all this and much more.

For instance, we cover:

Storing gold overseas clearly holds more counterparty risk. But the reason to send a portion of your gold overseas is for an entirely different objective.

The US government has, in the past, outlawed private ownership of gold, and confiscated it from citizens.

Putting people in prison for owning gold was one of Franklin D. Roosevelt’s brilliant ideas we talked about earlier.

For asset protection purposes, and for the ability to hedge against what might happen– or is happening– in your country, it makes sense to send a portion of your savings overseas, to a secure storage facility, in the form of bullion bars.

Storing gold overseas is legal, and it keeps a portion of your savings safe and secure.

Bars make sense when stored offshore, simply because they are more compact and make storage easier and cheaper.

One great option is in Singapore. They have one of the best, most well thought out security systems in the world… and they also let you do peer-to-peer lending or borrowing based on gold instead of on paper (fiat) currencies.

So you could actually borrow against your own gold holdings, and literally spend money backed by your own gold. As long as you pay the loan back, your gold remains yours.

The fact that Singapore is a relatively safe jurisdiction with a wealthy government makes it that much better.

We cover this storage facility and their precious metals based peer-to-peer lending platform in more detail in our free Ultimate Gold and Silver Guide.

Keeping a portion of your savings in gold protects you against the endless money printing of your government and the potential decline of the currency.

It makes a lot of sense in the long run, but you can’t keep all your savings in gold.

But keeping your money in a bank account may not be as safe as banks want you to believe.

One reason is that the FDIC (Federal Deposit Insurance Corporation) only has enough money to handle a handful of banks going under per year– not an entire collapse of the banking system.

The FDIC has $109 billion in reserves. But the entire US banking system has $13 TRILLION.

That’s less than 1%! During normal times (when the economy is performing, unemployment is low and steady, banks are not collapsing, etc.), the FDIC’s capital is sufficient to save a failing bank here and there.

But COVID-19 has made it painfully obvious that these are not normal times ahead.

The Covid-19 impact on the banking system could be 10x bigger than the housing meltdown in 2008.

Global debt is a staggering $250 TRILLION.

That’s more than 176% of global Gross Domestic Product (GDP), or the entire economic output of every single country in the world.

We are seeing entire economies shut down, and unemployment at all-time highs world wide.

Many people are not paying their mortgages, car payments, and credit card bills. Businesses, who have taken on some of the riskiest debt of all, are going under and defaulting on their loans.

And it’s the banks that are ultimately on the hook.

Without even getting into how banks like Wells Fargo have abused and swindled their customers time and time again… it makes a lot of sense to cut out the counterparty risk you have with banks.

One way is to simply keep some physical cash in your home safe.

But there’s an even better way…

Make a short-term, gold-backed peer-to-peer loan through a precious metals storage facility in Singapore called Silver Bullion.

When you loan money to someone who has gold or silver deposited at the facility, their precious metals serve as collateral on the loan. And you earn up to 3.5% interest.

That’s 58 times more than what you are earning at the national average savings account interest rate. And it’s significantly safer.

You have ZERO exposure to the banking system, because you are making a loan directly to another person.

Silver Bullion is just the facilitator.

But unlike with most peer-to-peer lending platforms, you have access to REAL collateral in the form of gold.

Each loan is backed by twice the amount of gold as collateral. So if you lend $10,000, the borrower has to provide you with $20,000 worth of collateral.

Should a borrower ever default on the loan, the gold is liquidated and the lender is paid back his principal and interest in full.

And should the value of the gold ever fall down to 110% of the outstanding loan amount, the gold will automatically be liquidated and the lender paid back (the outstanding balance goes back to the borrower).

Silver Bullion even has safeguards to make sure no one borrows twice against the same precious metals.

It’s an extremely safe way to cut out your exposure to the traditional financial system AND earn interest.

And of course it works in the reverse as well. If you would like to keep a portion of your savings in gold or silver in Silver Bullion’s storage facility, you can take out a peer-to-peer loan against your precious metals.

That gives your precious metals some liquidity, without having to sell them. As long as you abide by the loan agreement, you can still use the capital you hold in precious metals.

It’s really revolutionary when you think about, and definitely is something worth considering.

Even though there is no currency backed by gold, you can still back yourself using precious metals.

Gold and silver are still the ultimate insurance policy when it comes to keeping your wealth safe.

They help you avoid inflation, hold savings without counterparty risk, and are universally recognized as valuable.

And in a worst case scenario, you can even use gold and silver as money.

As we have shown, the US government and Federal Reserve have put US dollars in a precarious position. And most fiat currencies around the world are not any better off.

You can’t guarantee the paper money in your bank account will still be valuable tomorrow or in a year’s time. But 5,000 years of history shows that gold and silver maintaining its value is a much safer bet.

It makes sense to start working on your personal gold standard today, in order to take back the power that central banks and bankrupt governments have over your life.

Our free Ultimate Gold and Silver guide goes into much more detail on precious metals, and also addresses other questions you might have, like investing in gold through mining companies or ETFs– definitely don’t invest in a gold ETF before reading our report.

It also covers:

It makes sense to think about these things now, before the dollar loses value. And also while the price of gold– and even more so silver– is still relatively low, compared to what it could be.

Download the free report now.

Learn EVERYTHING you need to know about

buying, owning, storing and investing in gold & silver…

Download our FREE precious metals report and learn…

Inside we have premium intelligence on how to get a valuable second passport (potentially for free), foreign banking, options to reduce, defer, or even eliminate your taxes, to incredible investment picks outside the mainstream and much more.

Join over 100,000 subscribers who receive our free Notes From the Field newsletter

where you’ll get real boots on the ground intelligence as we travel the world and seek out the best opportunities for our readers.

It’s free, it’s packed with information, and best of all, it’s short… there’s no verbose pontification here– we both have better things to do with our time.

And while I appreciate all the visitors who stop by our website, I provide special bonuses to our email subscribers… including free premium intelligence reports and other valuable content that I only share with them.

It’s definitely worth your while to sign-up, and if you don’t like it, you can unsubscribe at any time.

How did you like this article?

Click one of the stars to add your vote...

Other readers gave this article an average rating of 5 stars.