[Editor’s note: What follows is Tim Price’s hilarious, satirical take on a recent Financial Times fawning article on “Lunch with Ben Bernanke” by associate editor Martin Wolf.]

—

After literally saving the universe while at the helm of the US Federal Reserve, its former chairman is now quietly pursuing lucrative speaking engagements and sinecures at hedge funds. Marty Fox meets him in Chicago:

—

At the allotted time of 2pm I am sitting at a booth at Bavette’s Bar and Boeuf steakhouse in Chicago. My mobile phone rings. It is Neb Nerbanke’s personal assistant. It transpires that I have gone to the wrong restaurant.

Fortunately it only takes my chair carriers five minutes to carry me hurriedly to the right venue. The restaurant is empty, cold and dark. It is also raining. Inside. Which is weird.

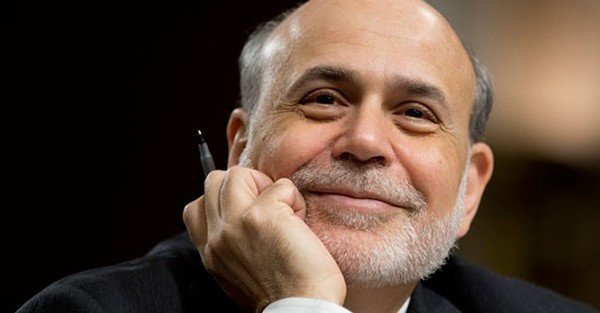

Nerbanke, 61, is waiting for me. He is wearing a plain brown suit and a luminous cravat. I have met him often since he became a governor of the US Federal Reserve in 2002. I am very important. He is very important. We are both very important.

It was good fortune indeed that this academic, scholar, raconteur, philosopher, lounge singer, poet, ladies’ man, acrobat and healer of sick people was chairman of the Fed during the biggest crisis that the Fed ever caused.

His new book, ‘I Am Neb Nerbanke’, provides a fascinating account of the effort to save the world from yet another Fed-caused catastrophe.

I start by praising his cravat, and then asking him how much the book tour will net him. “A few million dollars,” he replies.

I suggest he will probably be considerably richer when it is over. “Yes,” he answers.

And what will he be doing afterwards? He reels off a list of lectures that would probably intimidate someone less intelligent than I.

Meanwhile he is based at the Money Institute, a centrist lobby group in Washington. He is doing some consulting. A little plastering. Some juggling. He plays the Andean nose flute. He does weddings. He is also on the speaker circuit.

The waitress takes our orders. I choose devilled peasant with a side order of minced pauper. He selects grilled sharecropper lightly drizzled with a blue cheese sauce.

I ask him whether he still takes an interest in the economy. “Why should I start now?” he replies. I snicker, sycophantically.

I ask him how he coped with the mild criticism sometimes leveled at the Fed. “Well, haters gonna hate,” he replies, toying with his portion of sharecropper and nibbling at it from time to time.

Many critics point out that the Fed essentially funneled billions of dollars to Wall Street while trashing the rest of the economy and destroying savers in the process.

So what does he say to those critics who accuse him of being an academic, living in an ivory tower far away from the concerns of ordinary people?

“f(x)=a0+Z(ancosnX+bnsinL)sin a+cos Xnx-b(a/xLn).”

I add that after so many trillions of dollars were conjured by the Fed out of thin air, many critics still fear the prospect of hyperinflation. “No. Because we’ve never had hyperinflation in the US. So clearly we never can and never will. Only an idiot would think that.”

I hate idiots, too. But I love Neb Nerbanke. And I think he loves me back.

What about QE? Skeptics might say that having expanded the Fed’s balance sheet by $4 trillion, QE has done nothing to aid the wider economy or the man in the street – it’s merely made bankers richer.

Can I ask you about the efficacy of QE? “No.”

Fair enough, I might add. On to communications policy. The Fed has had its fair share of critics over the much-heralded strategy of ‘forward guidance’. So what do you say to those critics who accuse the Fed’s guidance of being difficult to follow?

“Fnnr gurrnn pffrumph trrwzzle zwiqshlgrpff twngzkzk arpffqfpkwzkk !”

Thank you. Moving on, could the Fed have prevented the failure of Lehman Brothers in 2008? “Absolutely not. It was completely unavoidable. Besides, Goldman Sachs asked us not to.”

But didn’t the Fed then bail out every other Wall Street firm and allow the likes of Goldman Sachs to convert to a bank holding company and thus qualify for Fed liquidity assistance direct, even though it isn’t actually a bank? “I must be going, Marty. As ever, it’s been a pleasure.”

I tell him the pleasure was all mine. Mmm. I worship Neb Nerbanke. I would willingly sell my house and all its contents just to have the untrammelled joy of sucking at the soles of his shoes.

Anyhow, that’s what our lunch was like. Just another day speaking truth to power.

——————————

McMorack & Schmuck’s

48E Upper Wacker Drive

Chicago, IL

Devilled peasant with minced pauper $22.99

Grilled Alabama sharecropper in blue cheese sauce $27.74

Double espresso $6.99

Tea $3.50

Fed balance sheet expansion to date $4,400,000,000,000

————————————————————————