On Wednesday, March 8, 2023, Fed Chairman Jerome Powell was sworn in for testimony in front of members of Congress to deliver remarks about the state of the US economy.

Inflation had been raging for well over a year at that point, and, in response, the Fed had rapidly increased interest rates to levels not seen since 2007.

But nothing happens in a vacuum. The Fed cannot expect to jack up rates without some major consequences. And concerned members of Congress asked the Chairman about these potential consequences.

But Chairman Powell played them off, practically dismissing any risk to their raising rates and ‘tightening’ monetary policy, saying “nothing about the data suggests we’ve tightened too much. . .”

Two days later, Silicon Valley Bank went bust– in large part because of the Fed’s interest rate increases.

And it wasn’t just Silicon Valley Bank that was in trouble. In fact, the FDIC reported over $600 billion in unrealized losses across the entire US banking system, and most of that due to higher interest rates.

It’s not hard to understand. Banks typically invest their customer deposits in either loans or bonds. And rule #1 with bonds is that, when interest rates rise, bond prices fall.

Even a first-day intern at the Fed would have known that. The Fed chairman should have certainly known that.

It was also in their own data. Remember, the Fed is also one of the key supervisors of the US banking system, so they had access to all of Silicon Valley Bank’s financial records. They saw the losses piling up, they saw the risks.

This is what’s so bizarre. The Fed always claims to be looking at the data and says that their economic prognostications are based on data.

But again, the Fed had the data. It was glaring at them. But they failed to anticipate any consequences to their rate hikes– even TWO DAYS before a major bank collapsed.

Sadly, the Fed chairman seems to have outdone even that bad call.

Last week he told a room full of reporters that economic weakness is “not what we’re seeing” and that the economic data are “not signaling a weak economy. . . ”

He went on to say that chances of a “hard landing are low” and that “the picture [of the US economy] is not one of slowing.”

Yet once again, literally days later, a meltdown in financial markets took place worldwide… because investors finally realized that the Fed has no idea what they’re talking about.

And everyone from Pepsi to McDonald’s to Heineken to Cartier to Porsche has been reporting slower growth or declines in sales.

This morning Disney reported a slowdown in its parks division– which is typically rock solid. Proctor & Gamble reported a decline in sales of Tide laundry detergent and Charmin toilet paper. The list goes on and on.

Monday’s sudden market swoon has calmed. But in large part that sense of calm is because investors are now pricing in a near 100% chance of a 50-basis point (0.5%) rate cut at the Fed’s September meeting. There are even some expectations of an emergency rate cut before the September meeting.

Again, they claimed just a week ago that the chances of a hard landing “are low”, and that a 50-basis point cut is “not something we’re thinking about”. Yet just days later, it became clear that the economy is slowing, and unemployment is moving higher.

(It’s also notable that most of the growth in labor market now is with government jobs, which actually hurt the economy.)

So, the Fed is almost certainly going to have to reverse itself and start making big rate cuts. Frankly, they have no other option, if for no other reason than the national debt.

The US government has trillions and trillions of dollars of bonds which are maturing this year and next. And the Treasury Department clearly doesn’t have the cash to pay them back. So instead, they’ll have to reissue more bonds to pay back the old bonds. Sounds a bit like a Ponzi scheme to me.

Their problem is that the new bonds will carry a much higher rate of interest than the old bonds… which the federal government absolutely cannot afford.

Think about it: $10 trillion worth of bonds paying a 1% coupon costs $100 billion per year in interest. That’s a lot, but it’s manageable. If they have to refinance $10 trillion at 5%, the annual interest bill increases to $500 billion… which is showstopper.

So, the Fed HAS to cut rates– not only to jump start the economy and prevent a recession… but to bail out the US government and give the Treasury Department the opportunity to refinance its debt at a lower rate.

However, these rate cuts, combined with yet another round of quantitative easing (i.e. money printing), will just end up bringing a LOT more inflation to the US economy.

Naturally the Fed is not forecasting any of this. They don’t see the inflation problem ahead. They keep claiming that they’re looking at the data… yet they consistently misdiagnose what’s happening in the economy.

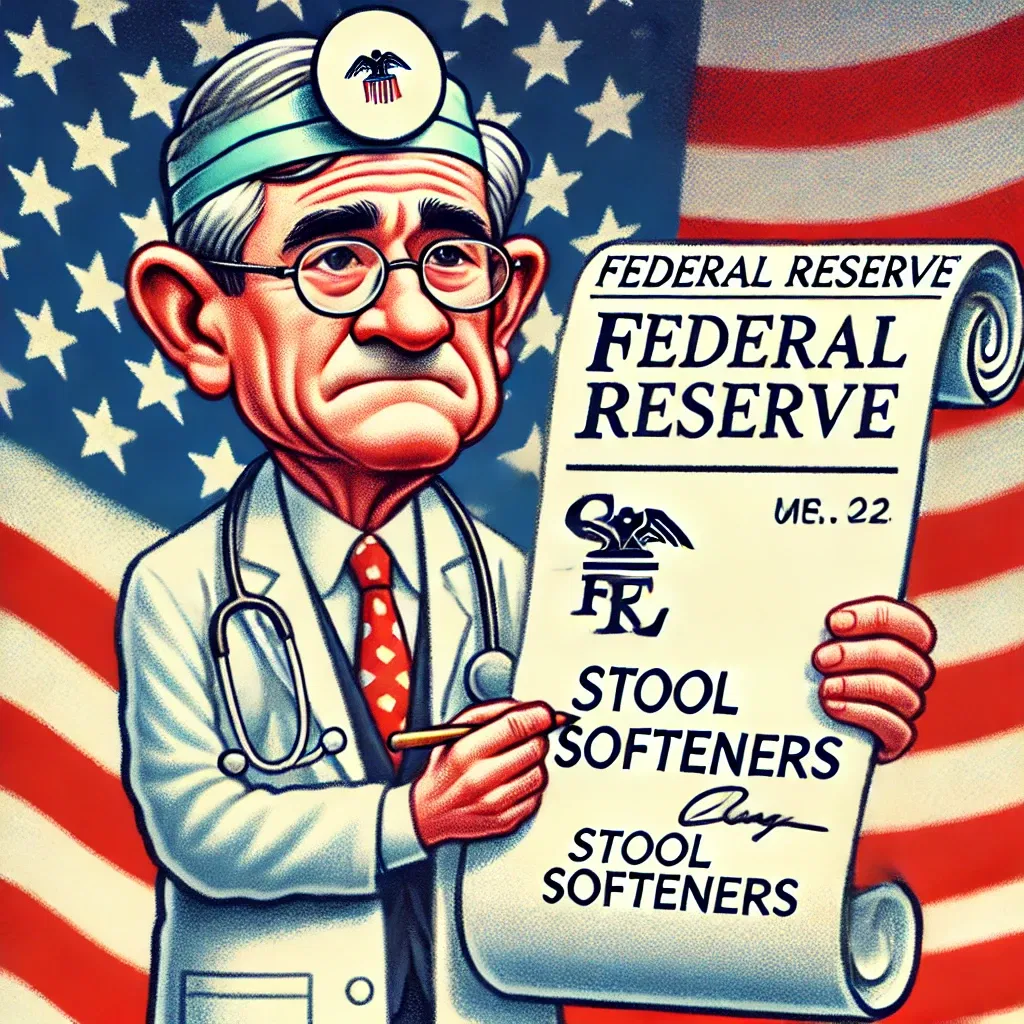

It’s like an ER doctor who examines a patient with a gunshot wound and prescribes a course of stool softeners. They’re missing what seems to be obvious to everyone else.

Look, these guys are human beings too. They’re not perfect, they’re going to make mistakes. But that’s the problem with this monetary system: a handful of bureaucrats with bad track records are awarded the most powerful authority in finance and expected to be infallible.

It’s a deeply, deeply flawed system, and it’s bizarre that anyone has any confidence in it.

The Fed is not all-powerful. Not only do they not see the coming danger, but they’re powerless to stop it. And Monday’s meltdown is a sign that the market is starting to figure that out.