July 21, 2014

London, England

[Editor’s note: This missive was penned by Tim Price, Director of Investment at PFP Wealth Management in the UK and frequent Sovereign Man contributor.]

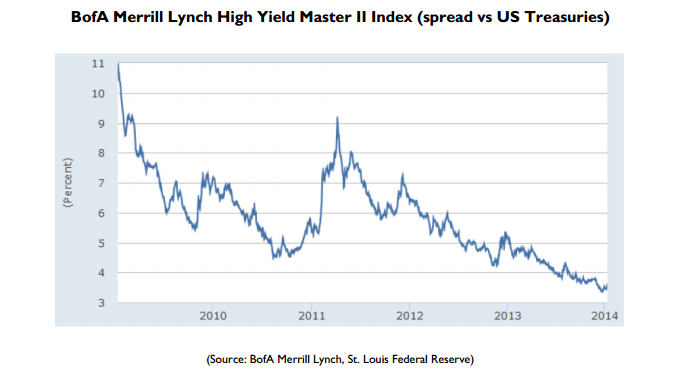

They call them ‘junk bonds’ for a reason. They now constitute an offence against linguistic decency: ‘high yield’ no longer even is. Consider the chart below:

(The index in question is a benchmark for the broad high yield bond market.)

Not for nothing did the Financial Times report at the weekend that “Retail investors are getting increasingly nervous about high-yield bonds”.

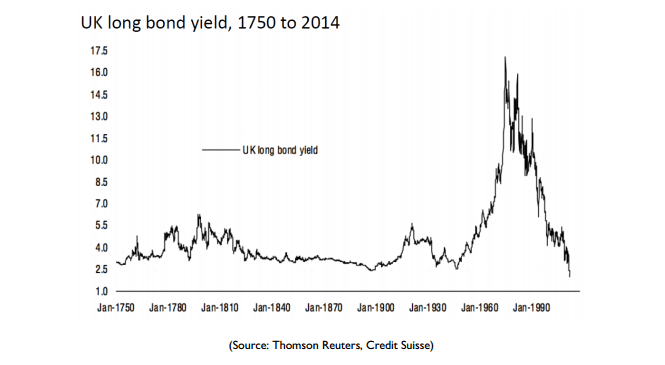

In the entire history of the UK Gilt market, yields have never been as low. This suggests that Gilt buyers at current levels are unlikely to enjoy an entirely blissful investment experience.

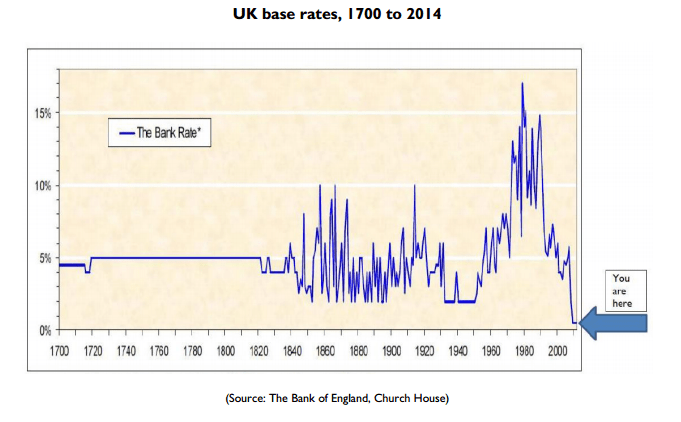

Just to round up this analysis of bond investor hyper-exuberance, consider this last chart, which puts interest rates (in this case, the UK base rate) in their historical context:

(*The Bank Rate has comprised variously the Bank Rate, Minimum Lending Rate, Minimum Band 1 Dealing Rate, Repo Rate and Official Bank Rate.)

There is one (inverse) correlation in investment markets that is pretty much iron-clad. If interest rates go up, bond prices go down.

This is entirely logical, since the coupon payments on bonds are typically fixed. If interest rates rise, that stream of fixed coupon payments loses its relative attractiveness.

The bond price must therefore fall to compensate fixed coupon investors. So now ask yourself a question: in what direction are interest rates likely to go next ?

The bond environment, ranging from high yield nonsense to government nonsense, is now fraught, littered with uncertainty and unexploded ammunition, and waiting nervously for the inevitable rate hike to come (or bracing for a perhaps messy inflationary outbreak if it doesn’t).

There are clearly superior choices on a risk-reward basis; we think Ben Graham-style value stocks are the logical and compelling alternative.

“By sacrificing quality an investor can obtain a higher income return from his bonds. Long experience has demonstrated that the ordinary investor is wiser to keep away from such high- yield bonds. While, taken as a whole, they may work out somewhat better in terms of overall return than the first-quality issues, they expose the owner to too many individual risks of untoward developments, ranging from disquieting price declines to actual default.”

– Ben Graham, ‘The Intelligent Investor’.