By the summer of 1563, all of Britain had plunged into chaos over religion and the Reformation.

King Henry VIII broke away from the Catholic church back in the 1530s, sparking a near civil war within the kingdom. Protestants killed Catholics, Catholics killed protestants, and extreme social tensions lasted for decades.

Universities were at the heart of this conflict; rather than focus on real subjects like science and mathematics, students and professors became radical social activists and turned their schools into ideological echo chambers. Sound familiar?

One of the few students who actually wanted to learn was a Scottish teenager named John Napier; Napier had been enrolled at the University of St. Andrews at the time, but he quickly realized that he would never learn a damn thing in that environment. So he dropped out… and started traveling in search of a real education.

No one quite knows exactly where he went or what he did. But when he returned to Scotland eight years later as a young man, Napier had become an intellectual giant.

You might not have ever heard of him, but John Napier was truly one of the great minds of his era. And modern science owes a tremendous debt to his work… in particular his development of logarithms.

If it’s been a few years since you studied math (or ‘maths’ for my British friends), logarithms are the inverse of exponential functions.

Simple example: we know that 102 (or 10 squared) = 10 x 10 = 100. So, the number 10 raised to the power of 2 equals 100.

The inverse of that is to say that the ‘base 10’ logarithm of 100 = 2. Or in mathematical terms, 100 log10 = 2

Napier devised an entire system of logarithms. And this was actually a tremendous leap forward in mathematics, because logarithms made it so much easier for scientists and researchers to calculate solutions to complex problems.

One of the many important applications to come out of Napier’s work is the concept of ‘logarithmic decay,’ which models many real world phenomena.

The idea behind logarithmic decay is that something declines very, very slowly at first. But, over a long period of time, the rate of decline becomes faster… and faster… and faster.

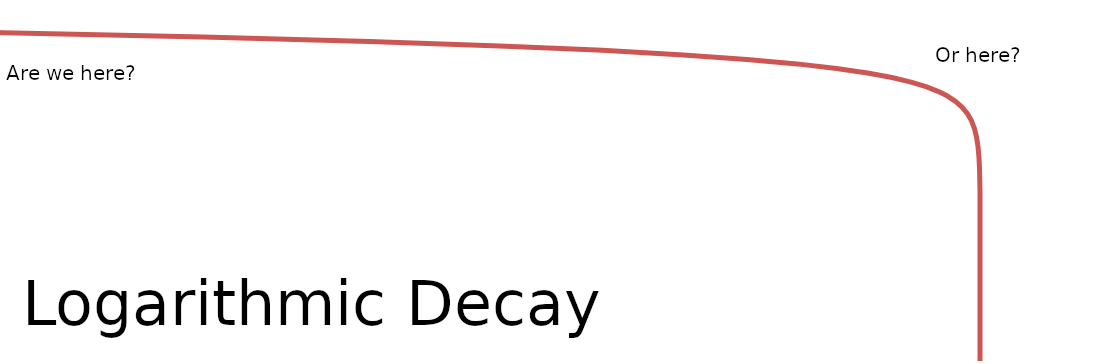

If you look at it on a graph, logarithmic decay basically looks like a horizontal line that almost imperceptibly arcs gently downwards. But eventually the arc downward becomes steeper and steeper until it’s practically a vertical line down.

Logarithmic decay is like how Hemingway famously described going bankrupt in The Sun Also Rises– “Gradually, then suddenly.”

In fact logarithmic decay is great way to describe social and financial decline. Even the rise and fall of superpowers are often logarithmic in scale. The Kingdom of France in the 1700s infamously fell gradually… then suddenly.

We can see the same logarithmic decay in the West today, and specifically the United States.

The deterioration of government finances has been gradual, then sudden. Social conflict, censorship, and the decline in basic civility has been gradual, then sudden. Even the loss of confidence in the US dollar has been gradual… and is poised to be sudden.

Back in 2009 when I started Sovereign Man, I spoke a lot about ideas that were highly controversial at the time.

I suggested that Social Security’s trust funds would run out of money. That the US government would eventually be buried by its gargantuan national debt. That the US dollar would eventually lose its international reserve dominance. That inflation and social conflict would rise.

The main thesis, quite simply, was that the US was in decline. And whenever I spoke at events, I used to talk about logarithmic decay, saying:

“As a civilization in decline, you never really know quite where you are on the curve. You could be way over here on the horizontal line, at the very beginning of the decline… or you could be standing on the precipice about to hit the vertical slide down.”

Well, now we have a much better idea of where we are on that logarithmic decay curve. Because these ideas about the national debt, inflation, social security, social conflict, etc. are no longer theories. Nor are they even remotely controversial.

Just last week, US Speaker of the House Kevin McCarthy said in a speech that “America’s debt is a ticking time bomb”. Social Security’s looming insolvency is now openly discussed in Washington and regularly reported in the Wall Street Journal.

We’ve all seen with our own eyes (and even experienced) inflation, social divisions, and censorship.

And as for the dollar, we continue to see a multitude of cracks in its dominance. Most notably, Saudi Arabia is considering a plan to sell oil not just in US dollars, but also in Chinese yuan.

Plus the international development bank of the BRICS nations (Brazil, Russia, India, China, and South Africa) announced earlier this month that they will start moving away from the dollar.

Is it any surprise? The US government is weeks away from defaulting on its national debt over the latest debt ceiling debacle. And yet the guy who shakes hands with thin air refuses to negotiate a single penny in spending cuts to help reduce trillions of dollars in future deficit spending.

The whole world is watching in utter disbelief at the astonishing level of incompetence that has infected the highest levels of America’s once hallowed institutions, including news media, big business, and the government itself.

America– and the West by extension– really are on the precipice of that logarithmic decay curve… the part where the horizontal line becomes a vertical line down.

It has taken years… even decades to reach this point, gradually. We’re now at the “suddenly” part.

Now, it’s important to note that the outcome is far from inevitable. Plenty of declining superpowers in the past have pulled themselves out of a tailspin, at least temporarily.

Aurelian’s reforms helped re-establish Rome’s dominance in the late 200s after nearly a century of chaos. The declining Ottoman Empire recovered substantially during the Tanzimat period in the 1800s. King Charles III of Spain made many successful reforms to revive his crumbling empire in the 1700s.

There are many historical precedents for recovery, so all is not lost. But at the moment there is little evidence to suggest any major change on the horizon.

I’m not saying this to be alarmist. Quite the contrary, in fact. Because one of the key pillars of our thinking here at Sovereign Man is that, despite the ineptitude of our governments, we as individuals have the tools, power, and freedom to solve these problems for ourselves… and even prosper doing so.

Simple example: Social Security’s trust funds will run out of money within a decade, and this will be a huge problem for literally tens of millions of people who depend on the progam.

However there are numerous tools available to solve this problem; a more robust and powerful retirement structure like a self-directed, solo 401(k) plan, for example, allows you to set aside up to $73,500 per year for your retirement.

Similarly, if you expect a government with deteriorating finances to raise taxes (which they almost always do), you can take completely legal steps to reduce what you owe.

If you anticipate inflation continuing, you can arrange your investments to capitalize on the surge in real assets, like minerals, energy, and productive technology.

You can also take steps to diversify geographically, even internationally, to reduce risks to your family’s freedom.

These solutions barely scratch the surface of the plentiful options at your disposal. All it takes is a sensible understanding of the problem… plus the willingness to take action.

And rational, informed action is always a better option than despair.