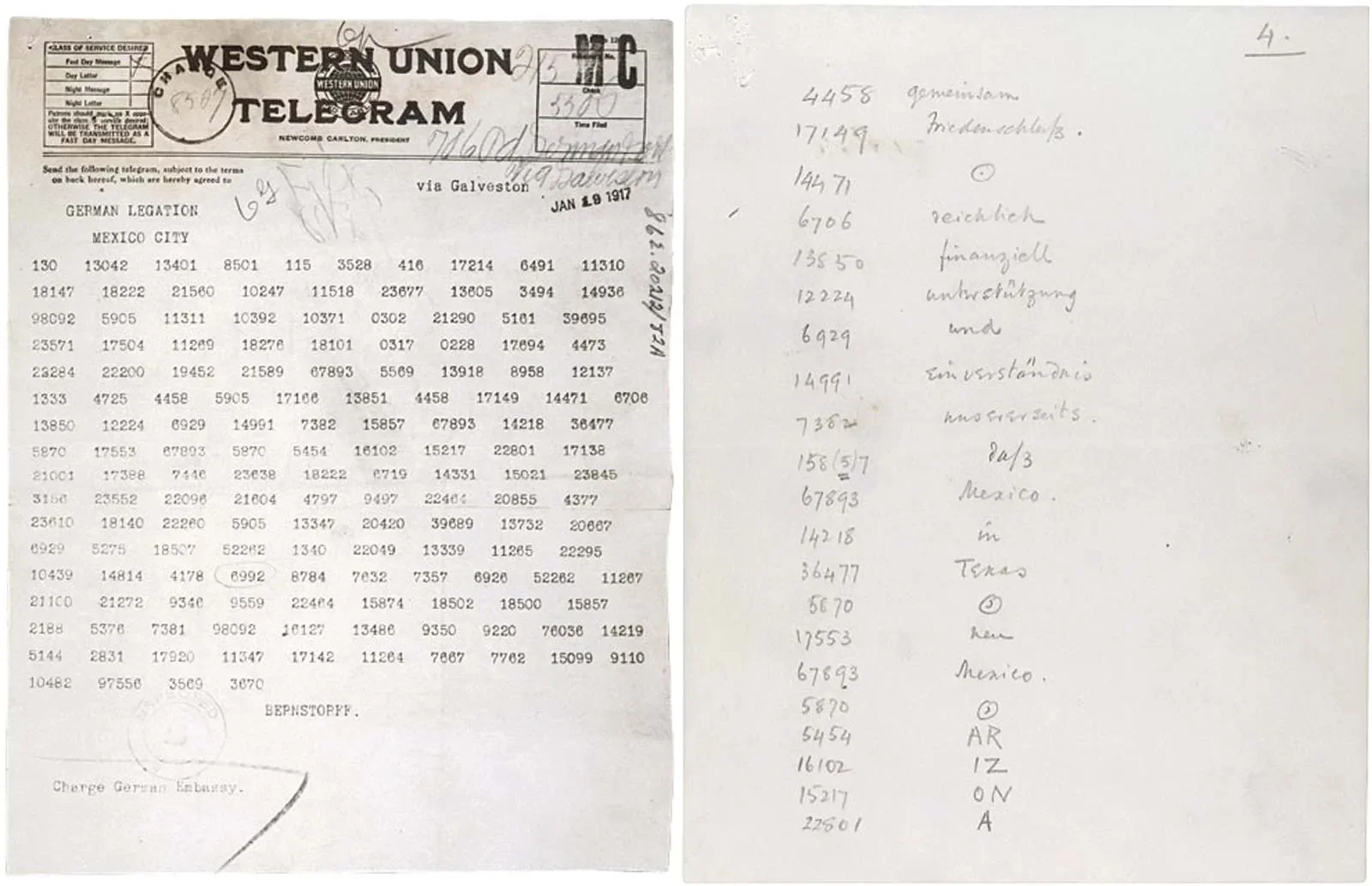

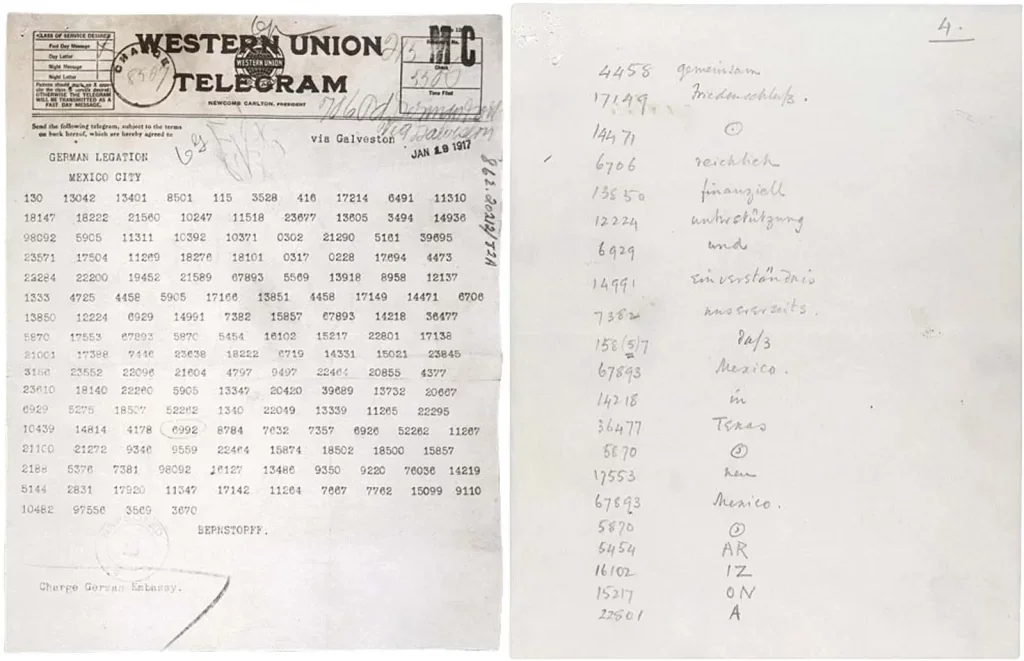

On January 16, 1917– at the peak of World War I, the imperial German Foreign Minister, Arthur Zimmerman, sent an encoded telegram destined for the President of Mexico.

Zimmerman wanted to form an alliance with Mexico, in the hopes that the United States would be too distracted with potential conflict at their southern border to even think about joining the war in Europe.

So, in his effort to strike a deal, Zimmerman promised not only a military alliance, but to help Mexico “reconquer her lost territories of Texas, New Mexico, and Arizona.”

Unfortunately for the German Empire, Zimmerman’s secret cable was intercepted and decoded by a British cryptography team; it was then shared with US President Woodrow Wilson, who released it to the newspapers on March 1st.

Americans were outraged, and five weeks later, the US joined the war… with the entire nation singularly focused on one goal: beating Germany.

The United States economy answered the call with remarkable vigor.

American businesses cranked out tanks, bullets, airplanes, fuel, provisions, and anything else needed for total victory. And as a result, companies which were vital to the war effort shot up in value.

The profits of the United States Steel Corporation, for example, more than quadrupled from 1915-1917, and the company became one of the first in history to be worth $1 billion.

Other companies, including Anaconda Copper, and various food and energy producers, also performed extremely well.

But eventually the war ended, and the roaring 20s began. The economy was flush with cash. Jobs were plentiful. Prosperity was everywhere.

And eventually the values of hard work and sacrifice were displaced by a culture of leisure and recreation.

These new values were reflected in the stock market.

Radio and motion picture were the hot new consumer technologies of that era. And the Radio Corporation of America– RCA– manufactured the radios and phonographs, produced music and records, owned broadcast stations (including the original NBC), and even bought movie theaters.

RCA was basically the Netflix and Apple of its day. And during the 1920s, RCA stock rose 200x… which was really a sign of the times. This was an era of peace and prosperity, so Americans prioritized consumption and recreation over production. And RCA was the ultimate consumer recreation stock.

But then the Great Depression set in at the end of the decade; RCA stock dropped 98% from a peak of $114.75 in 1929 to $2.62 in 1932.

Suddenly, American values had changed again. Money was no longer plentiful, and people had to make tough decisions about what to buy.

Hard work and sacrifice were back in vogue, and spending money on leisure and recreation seemed absolutely insane.

Once again, this shift in values was reflected in the stock market.

Recreation-oriented companies were out, while ‘boring’ companies like Proctor & Gamble– which efficiently manufactured the most critical consumer staples– became the best performers of the era.

Energy companies also did very well, because, when push comes to shove and consumers have to make decisions about where to allocate scarce resources, energy (along with food) almost invariably ranks towards the top.

This cycle has repeated again and again throughout history. During boom times, the world’s most critical resources like food, energy, and raw materials often become forgotten investments. Meanwhile, investors chase hot fads which are usually oriented towards consumer leisure and recreation.

We’ve seen this in our own recent history.

Netflix is a great example; it’s often (hilariously) referred to as a technology company. But Netflix is obviously in the recreation business.

So is Facebook (Meta) for that matter, whose products really just enable people to waste time by swiping and scrolling through endless butt selfies.

Apple designs the devices which people use to swipe and scroll. Amazon makes it super easy for people to spend money on stuff they don’t really need.

You get the idea. These are ultimately consumer recreation businesses… and there’s nothing wrong with that. But it is worth noting that the most valuable companies in the world are predominantly in this consumer recreation sector.

That’s because most of the last 15 years has been an era of abundance, similar to the Roaring 20s. And with so much boundless prosperity, consumer recreation once again became a major financial priority, whereas something as banal as energy production simply fell off the list of core economic values.

Think about it: we constantly hear famous economists praise the “American Consumer”. No one ever talks about the American Producer. And certainly not the American Energy Producer.

But values can and do shift very quickly. Just look at Pfizer.

As recently as 2019, Big Pharma had been among the most hated sectors in the world due to sky-high drug prices. But then the pandemic came along, and suddenly everyone started exuberantly supporting Big Pharma.

Priorities shifted. And Pfizer became one of the world’s most valuable companies.

I believe that priorities are on track to shift again, given how the US government’s massive debt problems will likely lead to sustained inflation within the next 5-7 years (if not sooner).

And as financial values and priorities shift, critical resources should take precedence over consumer recreation once again.

This doesn’t mean that consumer businesses will go bust. However, the sky-high valuations that we’ve seen (like 50x Price/Earnings ratios) for recreation-oriented businesses will not last.

Conversely, critical resource businesses will likely surge in value.

These are companies which have been mostly ignored (or even deliberately injured) … which means that many such businesses are selling for historically low valuations.

But over the next several years as priorities shift again, they could easily become the ‘must own’, best performing companies in the world.