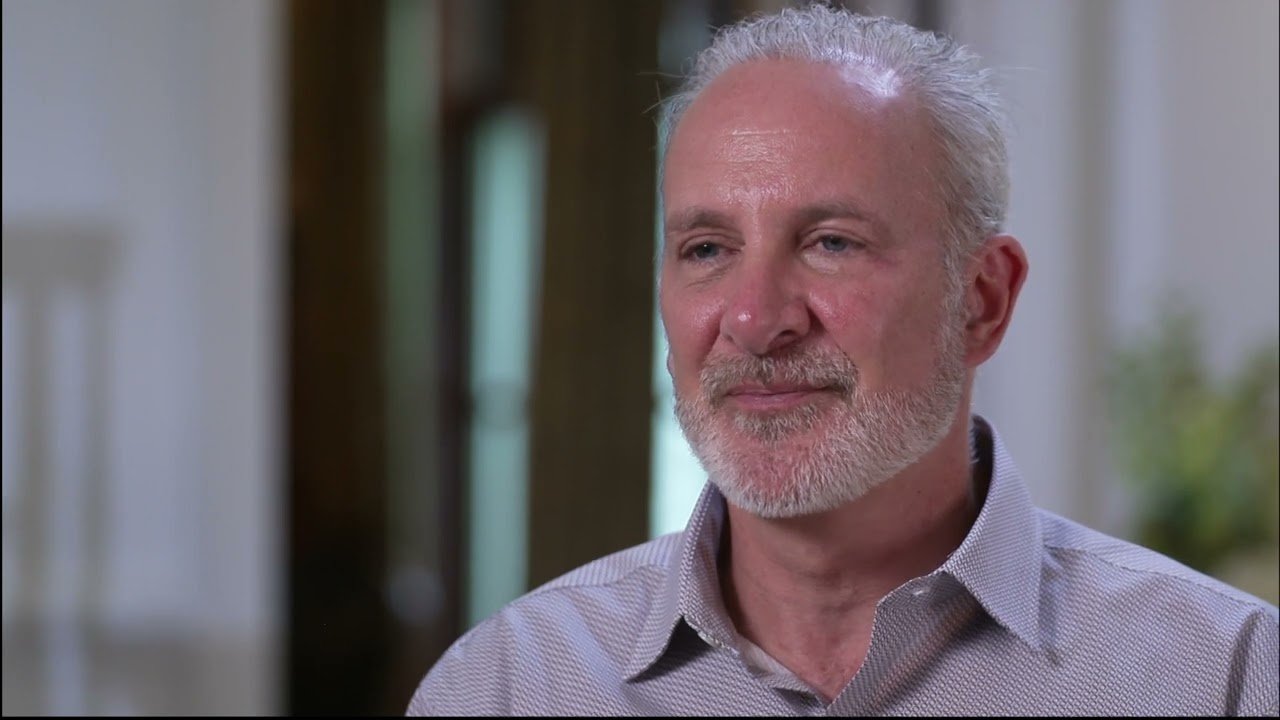

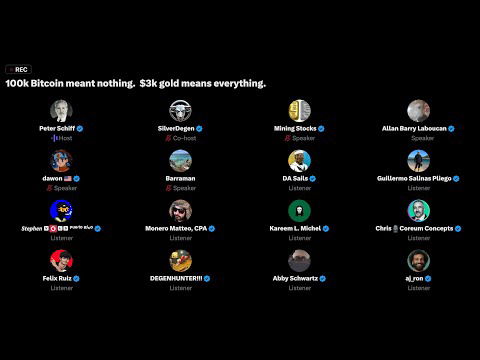

I’ve waited almost three years to get a copy of this unedited 60 Minutes Australia ambush interview. I won a defamation lawsuit against 60 Minutes, The Age and Nick Mckenzie, the journalist who interviewed me. It was only through compelled discovery that I was finally able to obtain the raw video. Mckenzie never intended for the public to see the actual interview, only his deceptively edited version that was fraudulently designed to make me look guilty. After he lost the defamation lawsuit his lawyer went back to court seeking an emergency injunction restraining me from publishing this video, based on the argument that the public should not be allowed to see “the inner workings of a broadcaster.”

At the time this interview was recorded I didn’t believe my bank was the target of an investigation, as the IRS agents who visited my house told me that my bank was merely a custodian of records that pertained to an investigation which they asked me to keep confidential.

But Nick Mckenzie must have been in possession of confidential Grand Jury information that was likely illegally leaked to him by an anonymous, corrupt government source. An ethical journalist would have refused to publish the information knowing that the investigation was still in its early stages. In fact, the head of the Australian Tax Authority repeatedly told Mckenzie it was too early to reveal the target of the investigation. But Mckenzie revealed it anyway.

The investigation ended without any charges being filed against the bank, or anyone running it. But the fact that Mckenzie exposed that the bank was being investigated and proclaimed the bank guilty was enough to cripple the bank financially. So even though the investigation itself completely exonerated the bank, the media’s decision to publicly expose the investigation led to the complete destruction of my bank.

The organized crime figure Simon Anquetil, who McKenzie claimed had an account at my bank, actually had an account in the past, but it was in the name of a company unrelated to Plutus Payroll, the company that committed the $100 million tax fraud in Australia. That corporate account was opened and subsequently closed several years before Anquetil’s criminal record was established. So at the time of this interview Simon Anquetil did not bank with my bank, as repeatedly alleged by McKenzie. Also, as he had no criminal record during the short period of time his account was active, my bank did nothing wrong by onboarding him as a customer.

More relevant, Anquetil actually tried to open an account at my bank on behalf Plutus Payroll, but that application was rejected. When authorities finally convicted Mr. Anquitel and a cadre of conspirators, it was found that Plutus Payroll laundered money using accounts at over 100 banks. My bank was not one of those banks, and ironically my bank may have been the only bank that refused to bank Plutus Payroll.

Also, discovery did not reveal that Mckenzie did any research that evidenced any organized crime figures using my bank, and neither the organized crime syndicate he mentioned nor Simon Anquetil were referenced in any of his notes or emails. All of that information was likely given to him illegally by a corrupt government official involved in the investigation, who Mckenzie is now protecting. But it was also unethical for McKenzie to have used information about a confidential criminal investigation that he knew was illegally obtained.

Finally, discovery revealed no attempt on the part of Mckenzie or anyone else to open an account at my bank, or even contact anyone still employed by the bank. They only spoke to anonymous former bank employees, all of whom verified the strength of the bank’s robust AML compliance. Even the independent referral agents they spoke with told them how difficult it was to open and account at my bank, how long it took, and how strict ongoing compliance was.

McKenzie lied when he said that the referral agents they spoke with recommended my bank for secrecy and tax evasion. Plus, all the former bank customers they spoke with also confirmed how difficult it was to open an account at my bank due to its extensive onboarding protocols, and how rigorous my bank vetted each individual transaction after an account was activated.

Now watch the deceptive way 60 Minutes edited it to create the false impress that I refused to answer questions about the bank and that I had something to hide.